Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

CoinTracker Partners with The Giving Block for Bitcoin Tuesday

We’ve partnered with The Giving Block to bring you the first Bitcoin Tuesday. It’s like Giving Tuesday, but for cryptocurrency.

November 26, 2019 · 2 min read

We’ve partnered with The Giving Block to bring you the first Bitcoin Tuesday. It’s like Giving Tuesday, for cryptocurrency. The team at The Giving Block has made it simple for you to donate by curating a list of participating nonprofits, including the Human Rights Foundation, The Tor Project, No Kid Hungry, US4Warriors, and more!

Donating cryptocurrency to charity is a great way to empower an organization that you believe in while reducing your tax bill in the process. It also gets non-profits to talk about cryptocurrency with their followers. It's a win-win-win!

Tax Implications

In the United States, donating cryptocurrency to a charity does not trigger a capital gain or loss. If you have held the cryptocurrency asset for more than one year, you are eligible to deduct the full, fair market value of the asset at the time of the donation. If you have held the crypto asset for a year or less, then you can deduct the lesser of (A) the asset's cost basis, or (B) the asset's fair market value at the time of donation. This means for a given coin you'll maximize your tax benefit by donating coins that you have held for more than one year.

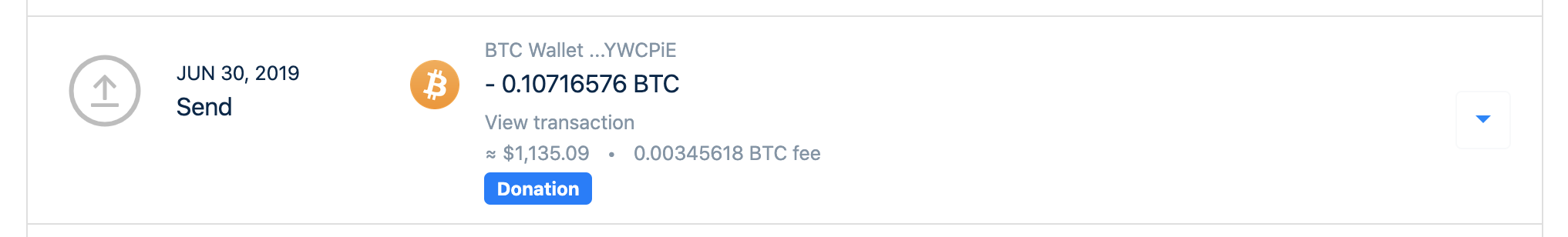

To keep track of your cryptocurrency donations and take advantage of the tax benefits, you can use CoinTracker to mark any donation (from the Transactions page) as a "Donation."

For more information check out how cryptocurrency gifts and donations are taxed. To find out more about Bitcoin Tuesday and select a charity to support, visit the official event website.

Donated? Tweet @CoinTracker with #BitcoinTuesday and the charity you picked!

Disclaimer: this post is informational only and is not meant as tax advice. For tax advice please speak with a tax professional.