Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Cryptocurrency Earnings Tax Guide

If you earn or receive cryptocurrency from mining, airdrops, or as a payment, tax requirements can be confusing. The good news is, CoinTracker can help you track and report on these transactions.

June 27, 2019 · 6 min read

If you earn or receive cryptocurrency from mining, airdrops, or as a payment, tax requirements can be confusing. The good news is, CoinTracker can help you track and report on these transactions.

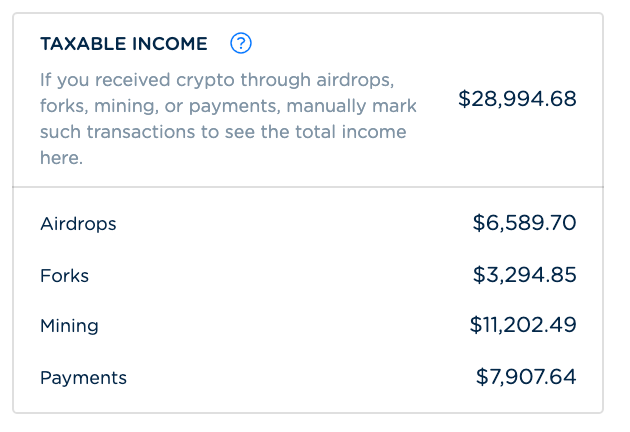

With CoinTracker, you can mark any received coins (from the Transactions page) as "airdropped", "forked", "payment", or "mined" so you can see the amount of income you had (on the Tax page), in addition to the capital gains which are already tracked.

Here are the latest requirements for reporting non-trading cryptocurrency income in the US, Canada, UK, and Australia, as of June, 2019:

United States

Mining

In the US, hobbyist and business miners are treated differently. The IRS distinguishes between these by considering factors such as:

- The manner in which the taxpayer carries out the activity

- The expertise of the taxpayer or his advisors

- The time and effort expended by the taxpayer in carrying on the activity

- Expectation that assets used in activity may appreciate in value

- The success of the taxpayer in carrying on other similar or dissimilar activities

- The taxpayer’s history of income or losses with respect to the activity

- The amount of occasional profits, if any, which are earned

In either case, you would report mined coins as taxable ordinary income and your cost basis would be the fair market value at the time you receive the coins.

Filing as a hobbyist miner:

- Income goes on line 21 (other income) of your Form 1040 Schedule 1 (Additional Income and Adjustments to Income)

- Expenses directly associated with mining will go on a Schedule A form (Itemized Deductions); miscellaneous subject to 2% of AGI limitation (does not apply in 2018 onward)

- Your income is not subject to the 15.3% self-employment tax (only normal income tax), however you receive fewer and less valuable deductions against your income

Filing as a business miner:

- Income and expenses both go on a Schedule C form (Profit or Loss from Business)

- Your income is subject to the 15.3% self-employment tax, though there are more valuable deductions against your income

Forks/Airdrops

In the US, there is limited guidance on the treatment of forks/airdrops. This may change in the future as the IRS works to update US cryptocurrency tax guidance. The most conservative and sensible approach seems to be following well-established “treasure trove” doctrine where the IRS has long held that “found” money is a taxable event.

Here’s how it works:

- If you own one bitcoin (BTC) and it forks into one bitcoin (BTC) and one bitcoin cash (BCH), then the one BCH you receive needs to be reported as taxable ordinary income (not a capital gain). This is true whether or not you sell your BCH.

- The amount used for reported income becomes your basis for the new BCH, and what you will use to calculate capital gains when you sell your BCH. The same logic applies if you were airdropped a new token.

There is also some debate as to the exact method for calculating the fair market value for the BCH.

- There may be a time delay between when a fork occurs and when you gain control of the forked coin depending on whether you are using a local wallet or an exchange wallet.

- One approach is taking the price at the time the forked coin (BCH) becomes available to you in your wallet (whether on an exchange or a local wallet) as the price for basis and taxable income.

- Some argue that the cost basis should be zero for forked coins and all upside should be considered capital gains, though this is a more aggressive approach. If you are unsure what to do, please consult your tax professional.

Payments

If you traded, sold, or used any of your cryptocurrency to purchase something, then you may need to pay tax on these assets. If you were gifted or given cryptocurrency as payment, salary, or as a gift/donation, then this income should be reported just like any other income you receive.

All US citizens and US residents are subject to a worldwide income tax. Any currency — fiat or crypto — earned anywhere in the world is taxable. For example buying a product/service using cryptocurrency that has appreciated in value is taxable, as is realizing a capital gain on a foreign crypto-exchange. In addition, states have their own tax regulations around cryptocurrency which may be in addition to whatever regulations apply.

Canada

Mining

In Canada, mining is considered a business operation. Mined coins are considered inventory and business income rules apply. Any costs associated with mining (e.g. equipment, electricity, etc.) can be deducted against mining proceeds, but it must be calculated on a per coin basis.

Forks/Airdrops

For airdrops and hard forks, while US guidance is unclear, in Canada the cost basis is zero for these coins. Therefore when the coins are disposed the entire proceeds are considered capital gains (for individuals) or income (for businesses).

Payments

The Canadian Revenue Agency (CRA) has issued guidance that virtual currencies are taxed like barter transactions, similar to the rules in the USA.

They also specify that virtual currencies can be traded like commodities, where any resulting gains or losses could be considered taxable income or capital. You can read about their bulletin (paragraphs 9 - 32) to determine which applies to you. The difference is that business income is included in taxable income at 100%, whereas capital gains are included in taxable income at 50% (as in the US, charges, fees, and commissions can be deducted).

United Kingdom

Mining

In the UK, when mining cryptocurrency, the fair market value of the coin at the time you gain possession of the coin counts as income incurred, and is treated as the cost basis for future capital gains/losses.

- As of the 2017/2018 tax year, the UK allows for £1,000 in trading income to be tax-free.

Forks/Airdrops

HMRC has clarified that Income Tax or Capital Gains tax treatment may apply based on the situation.

Airdrops that are provided in return for, or in expectation of, a service are subject to Income Tax either as:

- miscellaneous income

- receipts of an existing trade

Income Tax will not always apply to airdropped cryptoassets received in a personal capacity. Income tax may not apply if they’re received:

- without doing anything in return (for example, not related to any service or other conditions)

- not as part of a trade or business involving cryptoassets or mining

By default, CoinTracker picks up airdrops to a tracked wallet as capital gains assets, but with the basis set to the fair market value at the time received.

You can either mark the airdropped coin as an "Airdrop" using the dropdown next to the receive transaction on the Transactions page which will switch it to Income tax treatment, or you can edit the transaction to make it seem like you paid 0.00000001 GBP for the airdropped coin which will essentially set the basis to zero for CGT treatment.

Payments

HMRC has clarified that Income Tax or Capital Gains tax treatment may apply depending on the situation.

Payments that are received in return for, or in expectation of, a service may be subject to Income Tax either as:

- miscellaneous income

- receipts of an existing trade

Income tax may not apply if they’re received:

- without doing anything in return (for example, not related to any service or other conditions)

- not as part of a trade or business involving cryptoassets or mining

Australia

Mining

If you are carrying on a business that involves transacting with cryptocurrency the trading stock rules apply, rather than the CGT rules. According to the ATO, examples of cryptocurrency businesses include:

- cryptocurrency trading businesses

- cryptocurrency mining businesses

- cryptocurrency exchange businesses (including ATMs).

Further, “not all people acquiring and disposing of cryptocurrency will be carrying on businesses. To be carrying on business, you will usually:

- carry on your activity for commercial reasons and in a commercially viable way

- undertake activities in a business-like manner. This would typically include preparing a business plan and acquiring capital assets or inventory in line with the business plan

- prepare accounting records and market a business name or product

- intend to make a profit or genuinely believe you will make a profit, even if you are unlikely to do so in the short term.

They also state there should be “repetition and regularity to your business activities, although one-off transactions can amount to a business in some cases.”

Forks/Airdrops

In the event of a cryptocurrency fork (e.g. one bitcoin cash issues for every bitcoin), no income is incurred. The cost basis for the new coins is $0 and ordinary capital gains will apply at the disposal time of the asset(s).

Note: if the forked coin is not held by a business instead of an individual, then the coin will continue to be treated as trading stock instead of a capital gain asset. The asset must be brought to account at the end of the income year.

Payments

Per the ATO, if a disposal of a cryptocurrency occurs as "a part of a business you carry on, the profits you make on disposal will be assessable as ordinary income and not as a capital gain."

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.