Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Foreign Filing Requirements for US Cryptocurrency Investors

This post explains foreign filing requirements (FBAR & FATCA) for US crypto taxpayers.

September 14, 2021 · 4 min read

Foreign tax filing requirements are one of the most often overlooked compliance items when preparing your crypto tax returns. Foreign crypto disclosure forms (Form 114 & Form 8938) are very important because a misstep can result in hefty fines and significant jail time. In this post we’ll explain the various foreign filing requirements: Report of Foreign Bank and Financial Accounts (FBAR) & Foreign Account Tax Compliance Act (FATCA), and how CoinTracker can help you with them.

Do I Have to Report Crypto on FBAR (Form 114)?

The Financial Crimes Enforcement Network (FinCEN) is United States Department of the Treasury that collects and analyzes information about financial transactions in order to combat financial crimes. They have a form called FBAR (aka FinCEN Form 114) for American taxpayers who have a financial interest in foreign financial accounts.

On November 13, 2019, Carole House (from FinCEN) confirmed at AICPA in Washington DC that FBAR is not required for cryptocurrency held in overseas exchanges like binance.com.

However, the FinCEN Notice 2020-2 issued on January 2021, states that the agency is intending to subject cryptocurrencies held in overseas locations to the Foreign Bank and Financial Accounts Reporting (FBAR) regime.

FATCA (IRS Form 8938) & Crypto Taxes

FATCA stands for Foreign Accounts Tax Compliance Act. In order to comply with this act, you may also have to file IRS Form 8938 (in addition to the FBAR). Your filing requirement may vary depending on your filing status, thresholds and other criteria. However, the general rule is that if you have assets (including cryptocurrencies) in a foreign exchange and the total value of those assets exceeds $50,000 ($100,000 if married filing jointly) on the last day of the tax year or $75,000 ($150,000 if married filing jointly) at any time during the year, you may have a filing obligation.

For example, at any time during 2020, even if for five minutes, you had cryptocurrency worth $75,000 in Binance.com, you may have a FATCA filing obligation. This can also be spread across multiple accounts (e.g. $5,00 in USDT on Binance.com, $5,000 in BTC on Binance.com, $5,000 on Bitfinex and $60,000 in JPY in a Japanese Bank). Since the aggregate value of all foreign accounts (crypto and fiat) are more than $75,000, all four accounts will be subject to the FATCA filing requirement.

The IRS has not issued clear guidance on whether or not FATCA is required for cryptocurrency. Therefore, if you fall into the thresholds, the conservative approach is to simply file (it is informational only — no extra taxes are due).

How CoinTracker Can Help You with Foreign Crypto Tax Filing

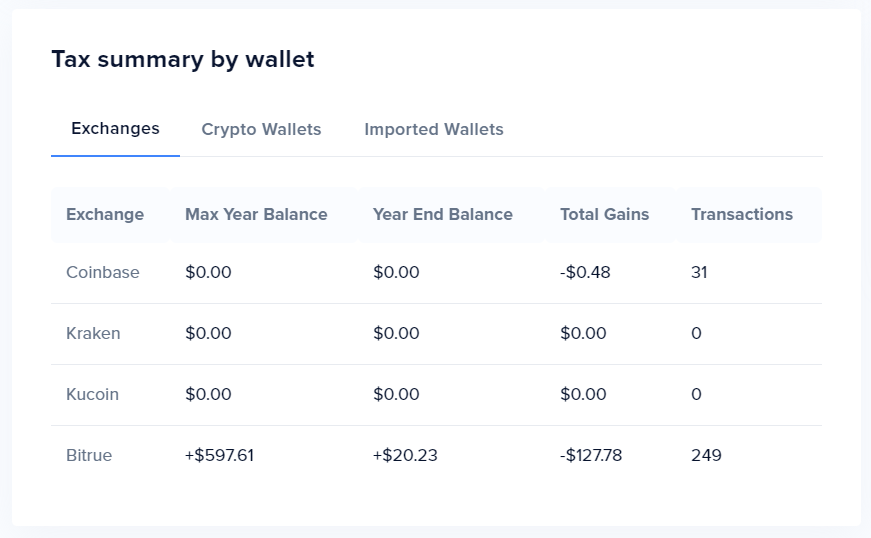

Cryptocurrencies can be highly volatile so it is extremely difficult to manually track the highest USD fair market value in ever foreign exchange in any given year for every coin in a taxpayer’s portfolio. Luckily, CoinTracker automatically calculates the value of your crypto accounts. You can use this information to complete IRS Form 8938.

Addresses of Foreign Cryptocurrency Exchanges

To make your life easier on the FATCA form, we have tabulated the addresses of common foreign exchanges to the best of our ability:

Bibox: https://www.bibox.com

Bibox Group Holdings Limited

Vistra Corporate Services Centre

Wickhams Cay II, Road Town, Tortola

VG1110

British Virgin Islands

Binance: https://www.binance.com

Binance Markets Limited

3 Beeston Place

London, England, SW1W 0JJ

Bitfinex: https://www.bitfinex.com

1308 Bank of America Tower, 13/F

12 Harcourt Road, Central

Hong Kong

BitMEX: https://www.bitmex.com

Capital City, 2nd Floor

Independence Avenue P.O. Box 1008

Victoria, Seychelles

Bitstamp: https://www.bitstamp.net

Bitstamp Ltd

5 New Street Square

London EC4A 3TW

United Kingdom

BTC Markets: https://www.btcmarkets.net

179 Queen Street

Suite 3, Level 8

Melbourne, Victoria

Australia

CEX: https://cex.io

One Canada Square

24th Floor

Canary Wharf, London

E14 5AB

United Kingdom

CoinExchange (Closing down on December 1, 2019): https://www.coinexchange.io

Australia

CoinSpot: https://www.coinspot.com.au

114 William Street

Melbourne, Victoria

Australia

Cryptopia (Closed as of May 15, 2019): https://www.cryptopia.co.nz

New Zealand

Gate: https://www.gate.io

P.O. Box 31119

Grand Pavilion, Hibiscus Way

802 West Bay Road

Grand Cayman KY1-1205

Cayman Islands

HitBTC: https://hitbtc.com

Hit Solution Limited

Unit 19, 7/F

One Midtown No.11

Hoi Shing Road,

Tsuen Wan, New Territories

Hong Kong

Huobi Global (not Huobi.com): https://www.hbg.com

Asia Square Tower 1

8 Marina View

Central Business District, 018961

Singapore

KuCoin: https://www.kucoin.com

#01-03 Ascent

20 Science Park Road

Singapore

Liqui (shut down on January 28, 2019): https://liqui.io

Quoine

2-2-1 Kyobashi

Chuoku, Tokyo

104-0031

Japan

OKEx: https://www.okex.com

Unit 10-02, Level 10

Menara Binjai No.2

Jalan Binjai, 50450

Kuala Lumpur, Malaysia

Poloniex: https://poloniex.com (shut down US operations in 2019)

Polo Digital Assets, Ltd.

F20, 1st Floor, Eden Plaza

Eden Island, Republic of Seychelles

QuadrigaCX (shut down on January 28, 2019): https://quadrigacx.com

46-1881 Steeles Avenue

West Toronto, ON M3H0A1

Canada

YoBit: https://yobit.net

Russia

Note: most cryptocurrency exchanges don't provide an account number, so you can simply enter “0001” as a placeholder. What matters is that you are making reasonable attempts at voluntarily coming forward and disclosing your foreign holdings.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.