Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Reduce Your Crypto Tax Bill with Smart Accounting

This guide walks you through how to reduce your crypto tax bill by using HIFO, FIFO & LIFO accounting.

September 24, 2020 · 5 min read

Crypto taxes can quickly add up — especially if you trade frequently. However savvy investors who use the tax code to their advantage can save big on crypto taxes by using some smart accounting techniques. For example using highest-in first-out based (HIFO) accounting can significantly reduce your tax liability.

How Crypto & Bitcoin Taxes Work

The IRS taxes cryptocurrencies like bitcoin as property. This means that each time you spend, trade, or exchange cryptocurrency, that triggers a taxable event. The amount of income tax and capital gains tax owed in a tax year is determined by three factors:

- The amount paid to acquire the asset (cost basis)

- The market value of the coin at the time of the transaction (proceeds)

- The difference between #2 and #1 (taxable income or loss)

Short term (10% – 37%) or long term (0% – 20%) capital gains tax rates will be applied to the capital gain amount, while capital losses can be written off subject to capital loss limitations.

Example

For example, let’s say Isabella sells 1 bitcoin (BTC) for $10,000. She purchased this BTC a few years ago for $2,000. Isabella’s capital gain would be $8,000 ($10,000 – $2,000).

If Isabella had a higher cost basis, the resulting gain and the tax bill would be lower. She can optimize her taxes and lower her capital gain by properly using a tax advantageous tax lot ID method called Specific identification. The Tax lot ID method dictates which cryptocurrency units you are deemed to be selling (not actually selling) for tax purposes.

Specific Identification Method

According to the crypto tax guidance issued by the IRS (A39), taxpayers can use specific identification to calculate the cost basis of each unit of crypto asset they are disposing of. Specific ID means that each time you dispose of a crypto asset, you are specifically identifying which specific unit you are selling. In order to use this method, you must keep detailed records of ALL the following information:

- the date and time each unit was acquired your basis and the fair market value of each unit at the time it was acquired

- the date and time each unit was sold, exchanged, or otherwise disposed of

- the fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.

- the fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit. A reputable cryptocurrency tax product can fulfill this requirement so you don't have to keep manual records.

Highest-In First-Out (HIFO) & Crypto Gains

Highest-in first-out (HIFO) is a programmatic subset of specific identification that always disposes of your highest cost basis lots of coins first. The result: the lowest capital gain possible. This generally leads to the least overall crypto taxes owed for most crypto users.

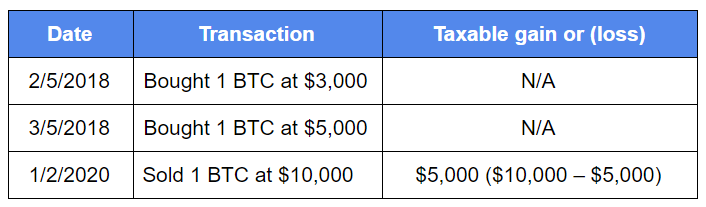

Example

For example, let’s say Isabella instead purchased 1 bitcoin (BTC) at $3,000 on February 5, 2018 on an exchange, and another BTC at $5,000 on March 5, 2018 which she moves to a hardware wallet. She sells 1 BTC for $10,000 in 2020 on the exchange. If she uses HIFO, for tax purposes, she can assign $5,000 as the cost basis for the BTC she sold. In reality, she could be selling the BTC she purchased on February 5, 2018 that is still on the exchange, but by setting up her accounting to dispose of the tax lot with the higher basis (using HIFO), she incurs $2,000 less in capital gains.

First-in First-Out (FIFO) & Crypto Gains

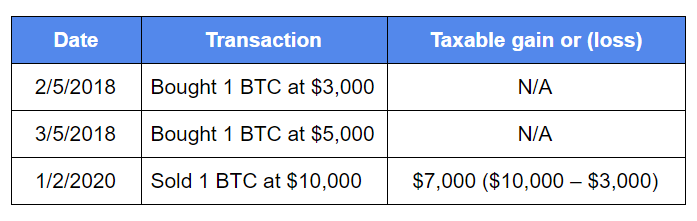

If a taxpayer doesn’t have detailed records to meet the Specific ID requirements, they must the First-In First-Out (FIFO) method to calculate their capital gains. This means each time they dispose of their crypto assets, they are disposing of the oldest coins they had first.

Example

Continuing with the previous example, under FIFO, Isabella’s capital gain would be $7,000, $2,000 higher than with using HIFO.

Universal Tracking vs. Per-Wallet Tracking

A question that arises when applying tax lot ID methods is how separating assets into distinct wallets impacts capital gains accounting. There are two options on this axis as well. The simplest approach is universal tracking, which means that there is one cost basis queue for each coin, across every wallet and exchange a taxpayer has. That means the tax lot ID method is applied universally. For example if you are using universal tracking with FIFO and you sell a bitcoin, you are selling a bitcoin regardless of which wallet / exchange it is coming from — from an accounting perspective, it is the first bitcoin you acquired.

The alternative option is to track per wallet. This means that there is a separate cost basis queue per coin and per wallet. So for example, if you apply FIFO accounting, it will apply separately to the first coin in your hardware wallet and separately to the first coin in your exchange wallet. This can be advantageous to some users who segment their crypto lots based on the value of their coins (e.g. a long time crypto investor who is holding highly appreciated bitcoin from eight years ago in a cold wallet and a separate batch of bitcoin on an exchange for trading). At the date of this posting, CoinTracker is the only crypto tax software tool that can track your cost basis on per-wallet and universal basis.

The reason that universal vs. per wallet tracking is allowed, is because it is simply another algorithmic subset of specific identification. If you can specifically identify the units you are deemed to be selling by meeting all the four specific ID criteria mentioned above, you can apply any tax lot ID method of your choice, including via universal tracking or per-wallet tracking. In other words, once you have the documentation to satisfy the specific ID requirements, boundaries set by wallets, exchanges or coins do not matter: you can pick your coin from anywhere.

Changing Tax Lot ID Methods

Although there is no direct guidance on changing tax lot ID methods, changing the method from year-to-year can be accomplished by using Specific ID. For example, you can go from FIFO to HIFO as long as you can specifically identify the units you are selling. Moreover you are not required to report which method you are using. You will only have to provide that info and substantiate your calculations if your tax return gets examined (so make sure you have good records!).

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.