Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Are you Considering These 4 Things When Choosing a Crypto Tax Software?

If you are a crypto holder, you definitely need a crypto tax software to calculate taxes.

January 8, 2020 · 5 min read

This article was originally published on Forbes by Shehan Chandrasekera on January 7, 2020

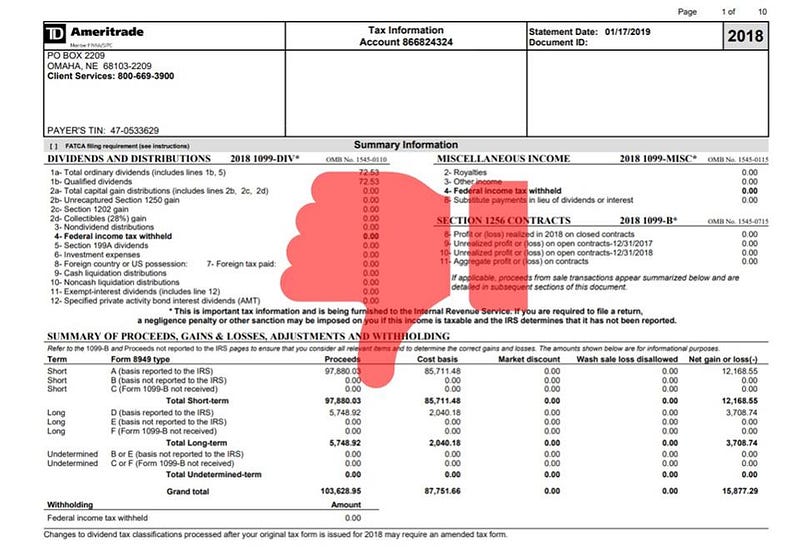

If you had any cryptocurrency transactions during 2019, a crypto tax software is an essential tool for you to calculate your cryptocurrency gains and losses. Cryptocurrency exchanges are different compared to traditional brokerages like Td Ameritrade or JPMorgan. At the end of the year, these brokerage houses issue a consolidated Form 1099 (see picture below) listing all your annual proceeds, cost basis & gains/losses arising from stock transactions. However, crypto exchanges like Coinbase & Gemini do not issue such forms at year end. They may issue a Form 1099-K listing all your gross transactions but this will not be useful in preparing your tax return. Therefore, the burden of properly calculating gains and losses to be reported on the tax return falls with you. The question is, how do you do that? Trust me, you can not do this on spreadsheets.

Luckily, there are a bunch of software in the market which can help you reconcile your cryptocurrency gains and losses. Although many of them claim that they calculate your “crypto taxes”, this is NOT the case. What these platforms are really doing is compiling all your cryptocurrency transactions from various sources and calculating gains and losses in US dollars by following the IRS guidance. (The actual taxes you owe on crypto gains are calculated on your tax return, not on these crypto tax software platforms)

How Do Crypto Tax Software Work?

In short, crypto tax software function as third party data aggregators. Users can purchase an annual subscription and connect their crypto exchanges, wallets, addresses, etc. Then the software reconciles the transactions and produces detailed gain and loss reports compatible with the IRS guidelines. Generally, these reports include Form 8949, Schedule D and in some cases, Schedule 1.

For the naked eye, all these platforms may look like a good solution in the upcoming tax season. However, each platform is different and has its own strengths and weaknesses. Since there are many choices, below is a list of items you should look at when choosing a crypto tax software tool for 2020 tax season.

1. Integrations & Bandwidth

The number one item you should look at when selecting a crypto tax software is the number of integrations. There are mainly two types of integrations: Application Programming Interface (API) import & Comma Separated Values (CSV) import. API is the most seamless and accurate way to import your wallet & exchange data into a tax platform. This may sound very technical but the process is really simple. You just have to copy the API key from your exchange/wallet and paste it on the crypto tax software platform. Once this is completed, the platform automatically downloads all the transactions and reconciles the transactions. CSV imports are a bit inconvenient and time consuming. It involves downloading the transaction history report in CSV format and uploading into the crypto tax software. In some cases, you will have to edit this transaction history report to comply with the format required by the software platform. You may also encounter more bugs in this process compared to API import. Therefore, more API integrations a platform has, more seamless and easier your life be.

Bandwidth is another important item to consider. This may not be advertised on the home page but look into the fine print or ask the customer service before purchasing. For example, there are many crypto tax software platforms that will offer you a subscription relatively cheap. However, if you have a lot of transactions, those platforms will fail to process them and crash. This is extremely important if you are an active cryptocurrency trader with thousands of transactions in different exchanges and wallets.

2. Credibility & Legitimacy

Since crypto tax software is an emerging space, checking the credibility and legitimacy of the software you use is super important. At the end of the day, you will be liable for the amounts reported on your tax return so you should do some due diligence when picking a software provider. One factor you can look into is the team behind the platform. Check if the team has any members from the tax compliance/regulatory space. For instance, teams with only technologists may lack the real work tax experience required to navigate this murky space. Ask the platform(or search on google) the initiatives they have taken with the IRS & other regulators. Other questions to ask and consider: Have you successfully helped taxpayers in defending amounts reported by their platform? How secure is my data? What kind of trade and industry organizations are they affiliated with? What kind of media presence do the company and its members have? Does the website/blog have up-to-date content on crypto taxes?

3. Price

The price may be the most important factor for you. Keep in mind that paying a small premium for higher integrations, bandwidth & credibility is well worth the cost. To give you an overview, for most platforms, pricing tiers depend on the number of transactions you have in a given tax year. Make sure to get advantage of a free CoinTracker account if you meet the criteria. If you have a lot of transactions, be prepared to pay higher prices.

Tip: sometimes you get bumped into the next higher pricing tier if you surpass the number of transactions in the previous tier by a small margin. In those cases, you can reach out to these platforms to make an exception so you can pay a lower fee.

Also, there are other platforms which charge based on the value of funds you have and other criteria.

4. Other Perks

Look for other perks that come with the subscription. In addition to gain/loss reconciliations some software platforms offer perks like free portfolio tracking, educational webinars, tax planning tools, etc. Another handy option offered by platforms is the ability to invite your accountant to view your account without sharing your own username and password. This is very convenient for your accountant and good for privacy. Your accountant will love this feature and you will save money by saving his/her time.

With the addition of the crypto question on Schedule 1, crypto is headed mainstream. Properly calculating your crypto gains & losses and producing the right tax forms is your responsibility. In order to meet your filing requirements, you should definitely leverage a good crypto tax software by assessing the criteria mentioned in this article.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.