Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

How Do I Report My Crypto Gains and Losses in the UK?

Self Assessment is a system HM Revenue and Customs (HMRC) uses to collect income tax on categories of income that have not been taxed automatically, such as cryptoassets.

December 16, 2022 · 3 min read

The income, gains, and/or losses from crypto transactions will be part of your overall tax assessment. Your income tax is usually deducted automatically when your employer pays you, but other sources of income, like crypto rewards and capital gain or loss transactions, will require you to file a Self Assessment tax return. Self Assessment is a system HM Revenue and Customs (HMRC) uses to collect income tax on categories of income that have not been taxed automatically, such as cryptoassets.

Filing crypto taxes online

HMRC allow you to file your taxes online. If you are new to reporting capital gains, you must register and create a government gateway account first. There are two different options depending on whether you are self-employed or not. If you are self-employed, you will have a business tax account and can add your self-assessment through that. If you are not self-employed, you can register a personal tax account using an SA1 form. Registrations for online reporting must be done by 5 October. If you’ve submitted a self-assessment tax return online in the past, you can sign into your existing account with your Unique Taxpayer Reference (UTR). Online filings are due by midnight on 31 January the following year. For example, the tax year ending on 5 April 2023 is due by 31 January 2024.

Filing crypto taxes by mail

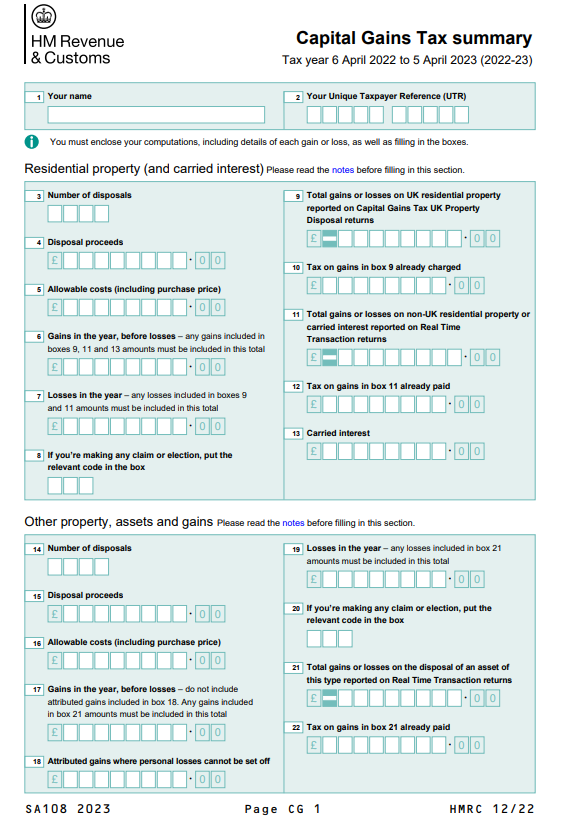

If you can’t file online, you can use commercial tax software or request the forms and mail them. If you choose to mail the forms, you will need to request the SA100 tax return from HMRC, and use the SA100 instructions to help fill out the form. Other income, like staking or mining rewards, will be reported in the other income section on page 3 in box 17, with a description of the income in box 21. You can download the capital gains summary (SA108). Here are samples of the forms:

Using a crypto tax calculator

Using a crypto tax calculator can make filing crypto taxes much more manageable. A crypto tax calculator will help you track crypto transactions, calculate gains and losses, categorize income, and generate the necessary reports to file with HMRC. Transacting cryptoassets can quickly become complex, making it very hard to keep accurate track of your holdings’ cost basis on your own. Perhaps you’re unsure how to handle taxes when you've transacted on both Crypto.com and Binance, transferred between them, or struggle to track decentralized transactions on the blockchain.

CoinTracker is designed to be simple and straightforward. All you have to do is connect your crypto exchanges, wallets, and other crypto accounts, and the app will handle the rest. From there, you can get performance insight into your entire crypto portfolio and your tax summary.

CoinTracker automatically imports your crypto transactions, generates tax reports with crypto-friendly labels, and provides capital gains summaries so you can file your crypto taxes in the UK with ease. Check out our United Kingdom Crypto Tax Guides for deeper insight into HMRC’s crypto rules. If you have any questions, don’t hesitate to reach out on Twitter @CoinTracker, and our team will be happy to assist.