Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

May 2023 Product Highlights

May 18, 2023 · 2 min read

That's a wrap for this year's US tax season! For anyone that filed an extension, you have until October 16 to complete your taxes. With CoinTracker, you can organize all your crypto transactions and get them tax-ready today. This month, our team is pumped to share our latest product launches:

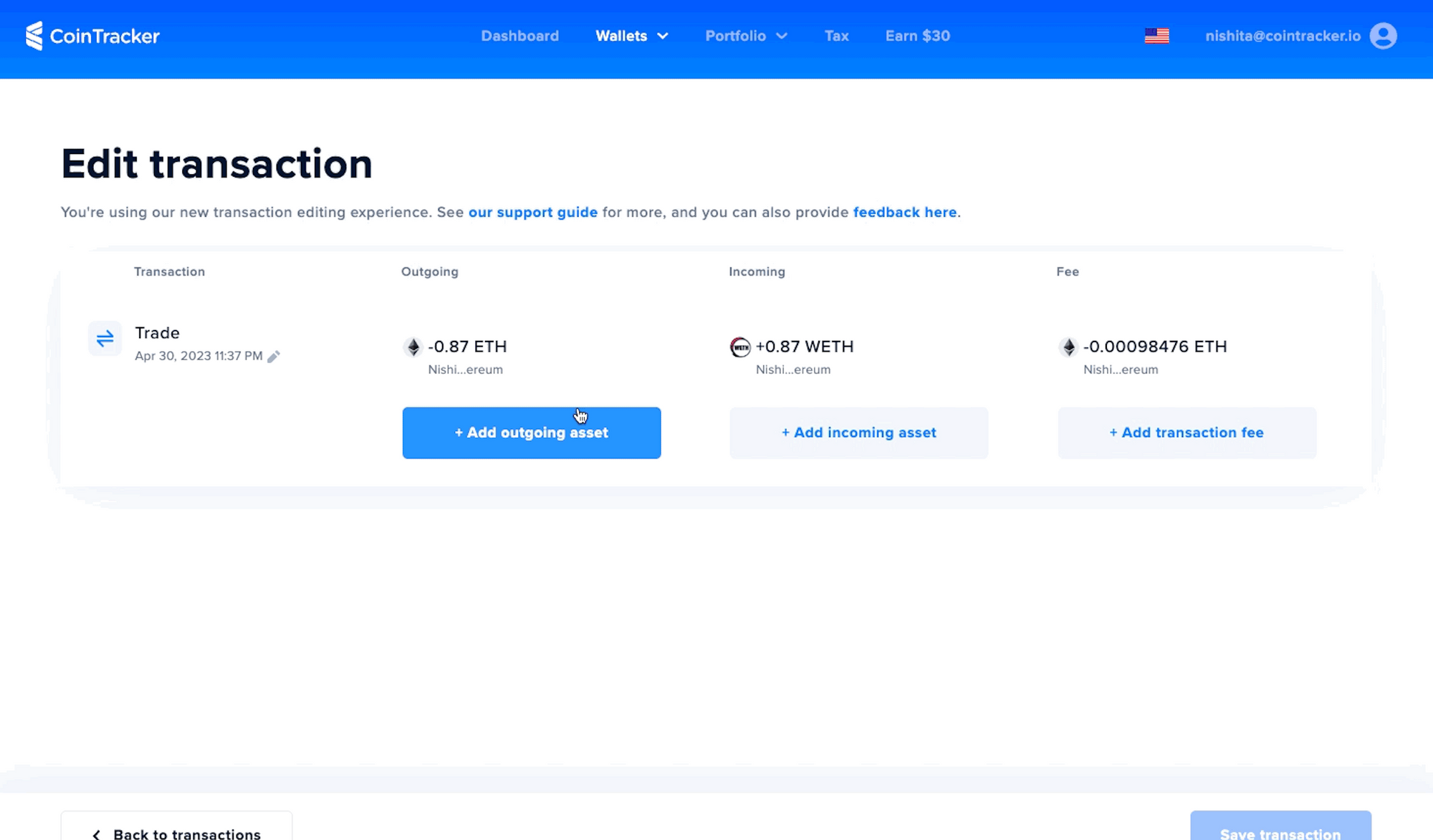

🎨 New transaction editing experience

You can now add, edit, and ignore specific assets within a transaction so your accounting and tax calculations are accurate. Once you're done editing your transaction, we will automatically kick off a new round of tax calculations so your reports are up-to-date.

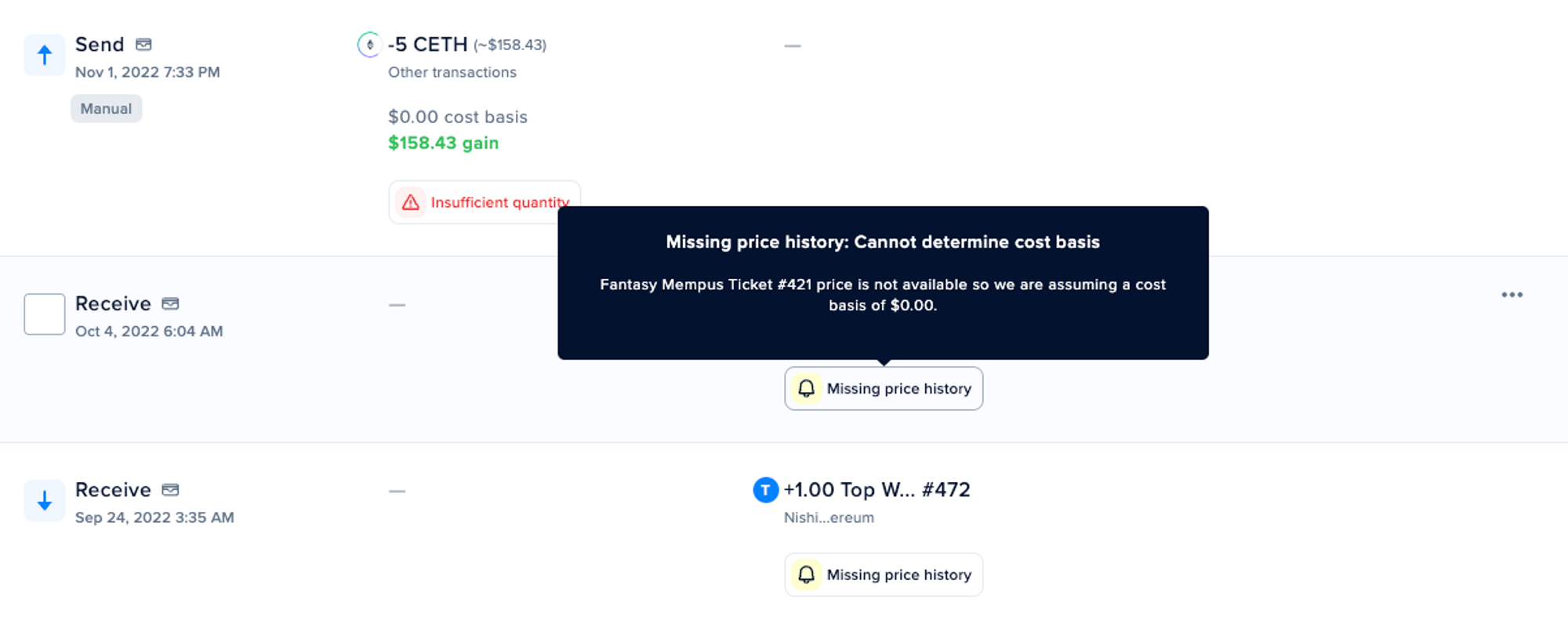

⚠️ Simplified transaction callouts

We know it can be a pain to review tons of transactions, especially low-value activity like spam airdrops. We shipped improvements to call these out as “optional review” instead of “needs review.” This helps you prioritize which transactions are top-of-mind for review and which you can skim if you’re in a rush.

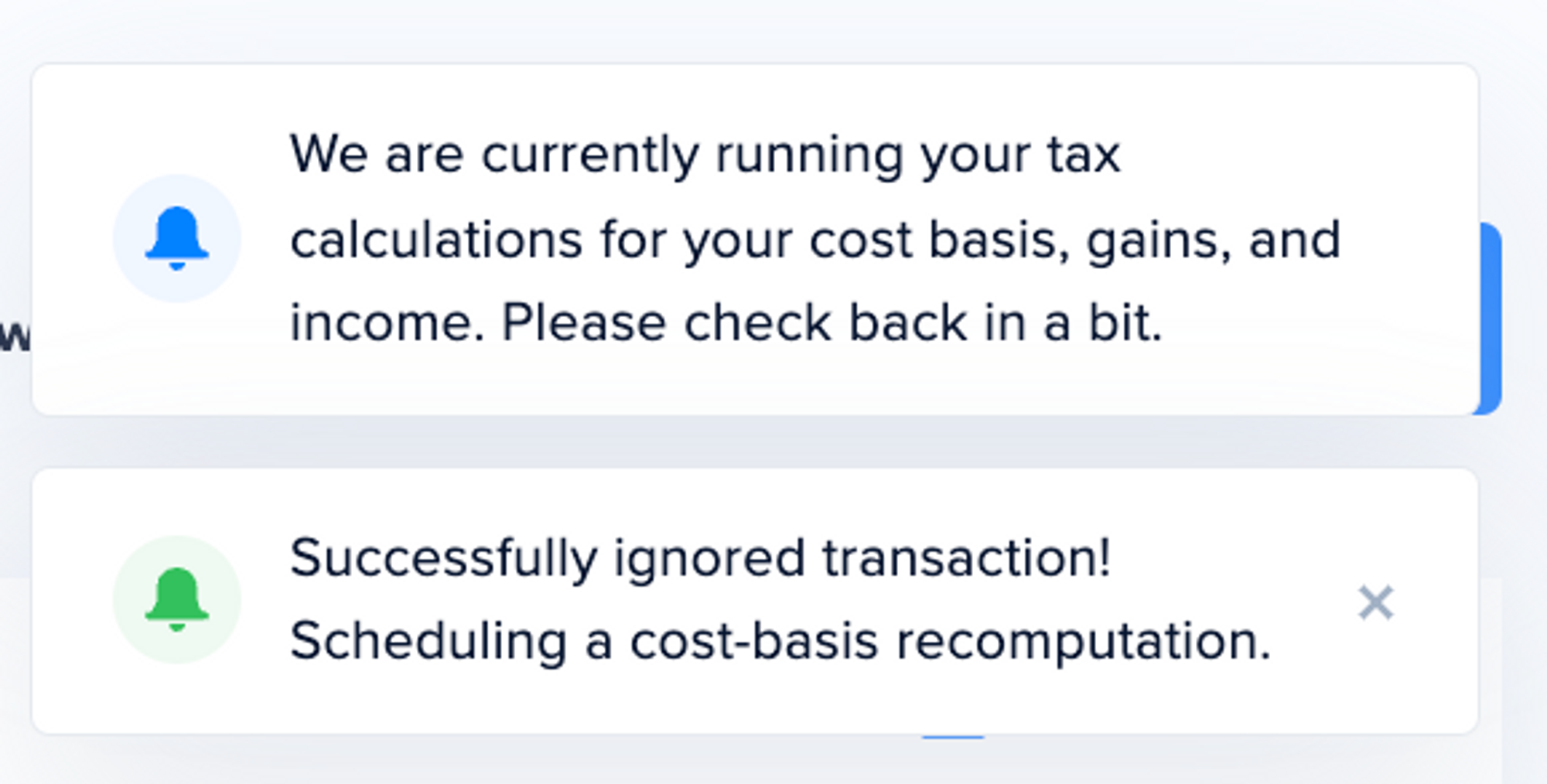

♻️ Clear cost basis calculations

When you make a change to your transactions, CoinTracker runs our accounting engine, so you have the most up-to-date cost basis, gains, and income calculations. We have launched a new feature that makes it clear when those tax calculations are running as you’re browsing your transactions.

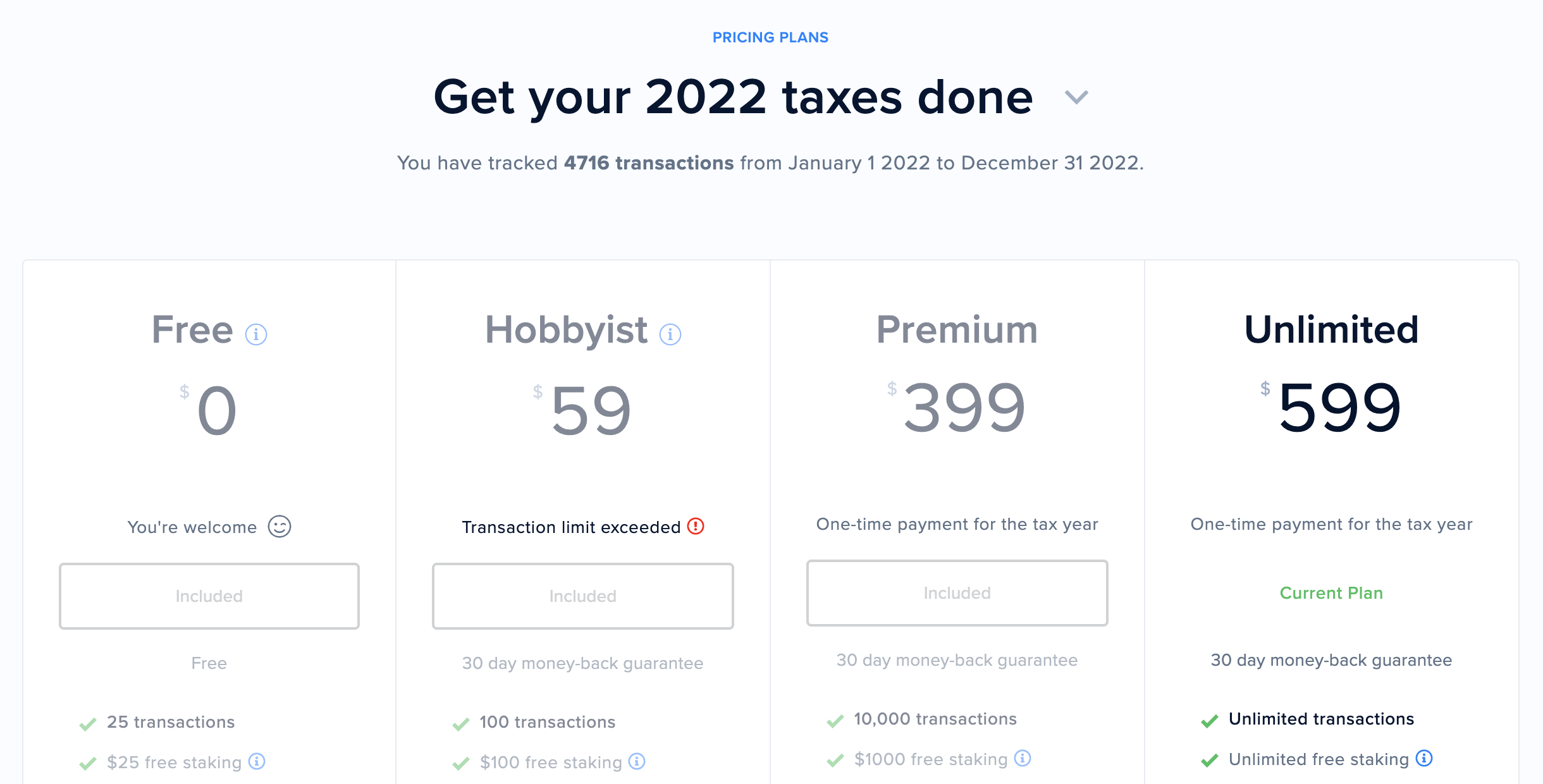

💸 Straightforward unlimited tax plan

We heard you loud and clear — our tax plan pricing was confusing. We recently updated our pricing with a simple unlimited transactions tax plan at $599. If you filed an extension and still need to get your crypto transactions sorted, find out which plan you need today.

There’s more! Here’s a list of a few more updates we wanted to share:

- Non-USD fiat transactions on Coinbase now import the correct currency

- Token detection fixed on Coinbase integration for ERN and FX

- Binance Convert transactions are now automatically synced

- Uphold integration bug now resolved to automatically sync all trades

You can also check out our new Cryptocurrency Staking Tax Guide that details the tax implications of the different types of crypto staking.

For more, follow us on Twitter!