Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Three-step Guide To Filing An Extension If You Have Crypto

April 16, 2022 · 2 min read

The deadline to file your 2023 personal income tax return is Tuesday, April 15, 2024. If you cannot file your taxes by this date, you should file a fast, free extension to get additional time to file. You need to know the following three items to successfully file for a tax extension.

1) Estimate how much tax you owe for 2023

Enter all the tax forms (W-2, 1099, etc.) you have received into a tax software of your preference. You may not receive a tax form for everything that happened in 2023, which could have an impact on your taxes. In that case, you will have to estimate the gain or loss occurring from those transactions for extension purposes. Don't worry; they don't have to be the exact amounts!

For example, you may not know how much gains you had on trading cryptocurrency during 2023 because you are still in the process of reconciling your records on CoinTracker. In this case, you can estimate a reasonable number as your profits and enter it into your tax program for extension purposes (all you are trying to do here is estimate your tax liability).

2) Subtract taxes you have already paid towards 2023

If most of your income comes from employee wages, the amount of tax you have paid towards 2023 will be on Box 2 of your W-2. If you are self-employed or have a business, you might have paid quarterly taxes to the IRS throughout 2023. Enter these amounts in your tax software.

Once steps 1 and 2 are complete, your tax software will show your estimated tax due amount for 2023.

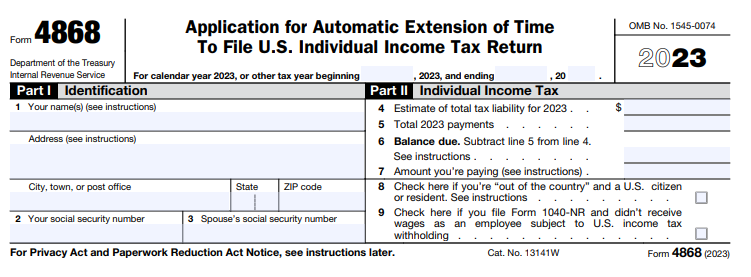

3) Complete Form 4868

Part I is self-explanatory, and steps 1 and 2 will help you complete Part II. Mail this form out according to the instructions or file it electronically with your tax software. Depending on the states you have income in, you must file separate extensions and pay any tax due in those states too.

You can extend your tax filing deadline to October 15, 2024, by filing an extension. If you owe taxes for the 2023 year, you have to pay this liability when you file your extension, or you could incur penalties and interest.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 8,000+ cryptocurrencies, and makes crypto tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.