Understanding the differences between specific and global allocation

As part of the Internal Revenue Service’s (IRS) new requirements outlined in Revenue Procedure 2024-28 (Rev. Proc. 2024-28), all U.S. crypto investors using the Universal cost basis tracking method must transition to the Per-Wallet cost basis tracking method starting January 1, 2025. While this transition will help align your records with those of the exchanges, it requires a decision on how to allocate any unused tax basis from pre-2025 holdings among your current holdings. Taxpayers can choos

As part of the Internal Revenue Service’s (IRS) new requirements outlined in Revenue Procedure 2024-28 (Rev. Proc. 2024-28), all U.S. crypto investors using the Universal cost basis tracking method must transition to the Per-Wallet cost basis tracking method starting January 1, 2025. While this transition will help align your records with those of the exchanges, it requires a decision on how to allocate any unused tax basis from pre-2025 holdings among your current holdings.

Taxpayers can choose between two methods: Specific Allocation, which assigns cost basis to individual units within specific wallets, and Global Allocation, which applies a uniform rule across all holdings. Each approach can have a different impact on your taxable gains and losses.

Refer to our blog post Compulsory Universal to Per-Wallet tracking method switch for your crypto - Rev. Proc. 2024-24 for information on this transition and how to complete it with CoinTracker.

CoinTracker supports global allocation with two tax lot ordering methods you can choose: highest cost, first received and highest cost, last received. The global allocation example in this article uses the highest cost, first received method.

Example: Chainlink transactions

To better understand the difference between Specific and Global Allocation methods, let’s consider a hypothetical scenario involving three Chainlink (LINK)purchases and one sale before the transition to Per-Wallet tracking.

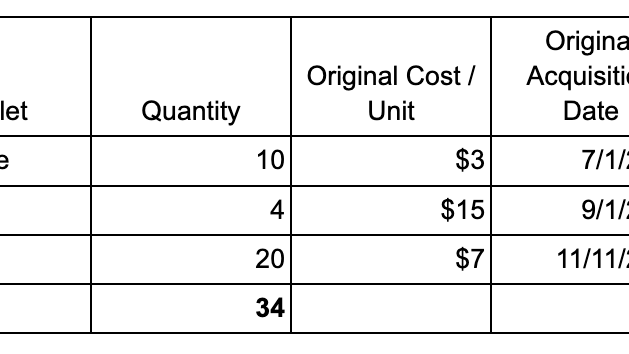

Transaction summary

Buys:

- July 1, 2019: 10 LINK purchased on Coinbase at $3 per unit.

- September 1, 2020: 20 LINK purchased on Kraken at $15 per unit.

- November 11, 2022: 20 LINK purchased on Binance at $7 per unit.

Sells:

- December 1, 2024: 6 LINK sold from Coinbase.

- December 20, 2024: 10 LINK sold from Binance.

Using the Universal HIFO (Highest in, First out) cost basis method of accounting, the December 1st and 20th sales pulls from the September 1, 2020, Kraken lot with a cost basis of $15 per unit.

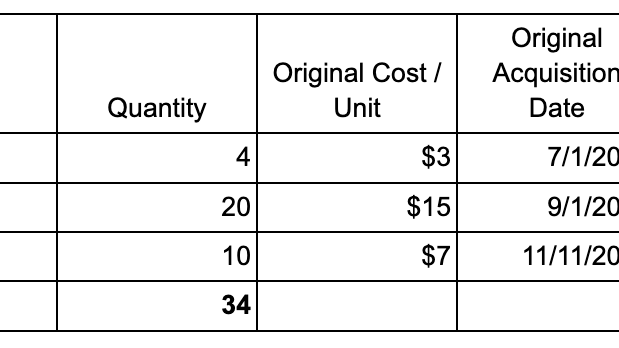

Holdings after the sale

After this sale, the remaining holdings vary depending on whether you’re looking at actual units (based on where they are held) or tax basis units (under Universal tracking).

Tax units (unused basis) remaining on 1/1/2025

Actual units remaining on 1/1/2025. (In simple terms, this is the actual number of units you will see if you log in to each exchange account on 1/1/2025)

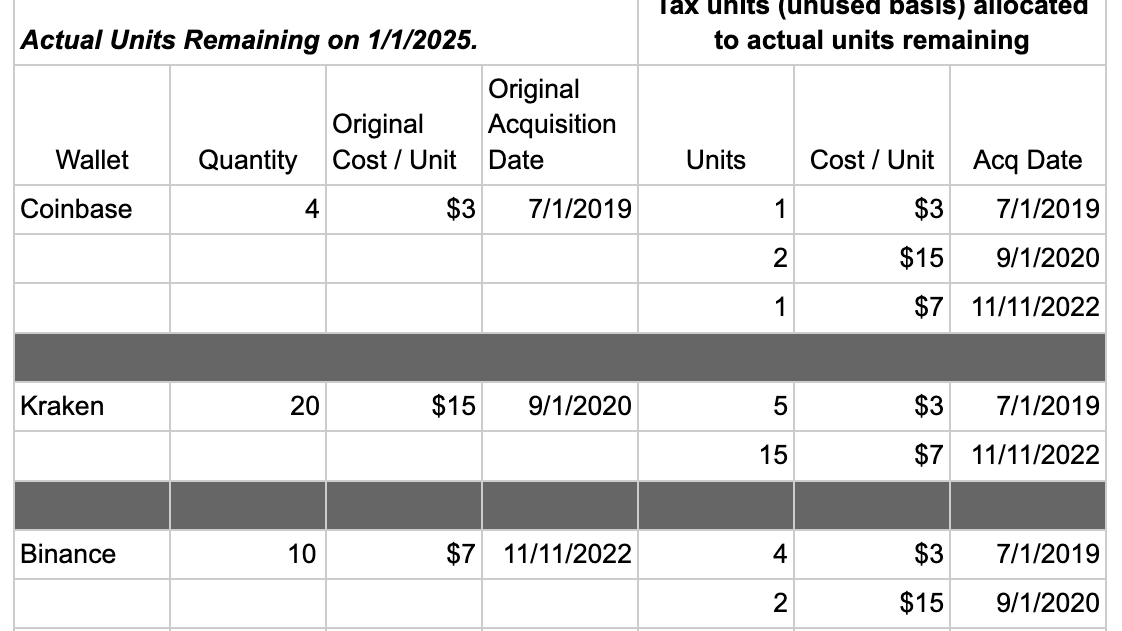

Specific unit allocation example

Before the sale or transfer of any units in 2025, the taxpayer needs to allocate their unused tax basis to the actual remaining holdings in each wallet to transition to the Per-Wallet tracking method.

Allocating the unused basis to remaining units

Using the Specific Unit Allocation method, the taxpayer allocates the unused tax basis as shown below. Note that the taxpayer has the discretion to allocate any remaining units of tax basis to any of the same assets (i.e., you cannot allocate BTC basis to ETH), and the allocation does not otherwise have to follow any order.

Coinbase Wallet

- Allocate 4 LINK tax units(unused basis) to the actual remaining LINK in Coinbase:

- 1 unit from the unused tax basis at $3 per unit (acquired July 1, 2019).

- 2 units from the unused tax basis at $15 per unit (acquired September 1, 2020).

- 1 unit from the unused tax basis at $7 per unit (acquired November 11, 2022).

Kraken Wallet

- Allocate 20 LINK tax units (unused basis) to the actual remaining LINK in Kraken:

- 5 units from the unused tax basis at $3 per unit (acquired July 1, 2019).

- 15 units from the unused tax basis at $7 per unit (acquired November 11, 2022).

Binance Wallet

- Allocate 10 LINK tax units (unused basis) to the actual remaining LINK in Binance:

- 4 units from the unused tax basis at $3 per unit (acquired July 1, 2019).

- 2 units from the unused tax basis at $15 per unit (acquired September 1, 2020).

- 4 units from the unused tax basis at $7 per unit (acquired November 11, 2022).

Consequently, the taxpayer’s updated holdings and allocated tax basis, as of January 1, 2025, are:

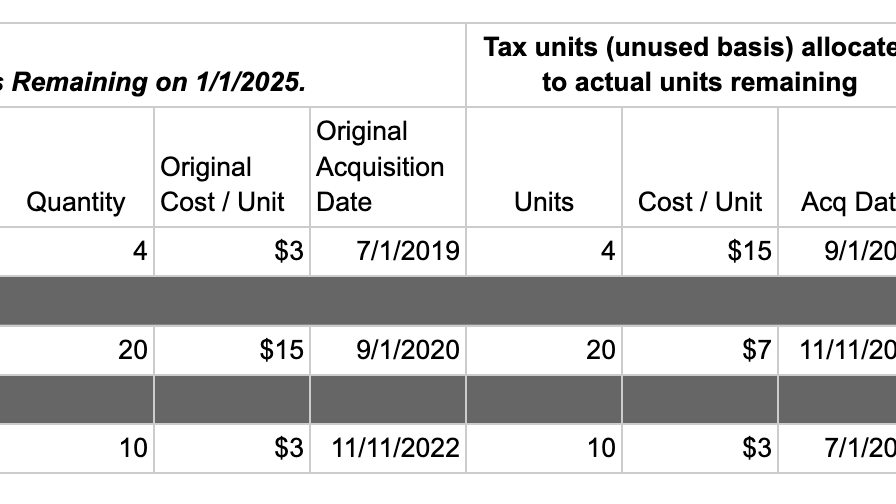

Global allocation example

Before January 1, 2025, the taxpayer establishes and records an ordering rule for allocating unused tax basis to remaining units. This rule states:

The units with the highest tax basis will be allocated based on the earliest acquisition dates.

Note: There is no requirement to disclose the rule on your tax return or report this to the IRS. You simply have to document the rule in your records by the deadline.

Allocating unused basis to remaining units

Using the above ordering rule, the taxpayer allocates the unused basis to the remaining actual units as follows before April 15, 2026, the due date of the taxpayer’s 2025 income tax return:

Coinbase Wallet

- Allocate 4 LINK tax basis units to actual remaining LINK in Coinbase acquired July 1, 2019:

- 4 units from the unused tax basis at $15 per unit.

- The taxpayer allocates the highest cost tax units to the earliest acquired coins.

Kraken Wallet

- Allocate 20 LINK tax basis units to actual remaining LINK in Kraken acquired September 1, 2020:

- 20 units from the unused tax basis at $7 per unit.

- The taxpayer allocates the second highest cost tax units to the next acquired coins.

Binance Wallet

- Allocate 10 LINK tax basis units to actual remaining LINK in Binance acquired November 11, 2022:

- 10 units from the unused tax basis at $3 per unit.

- The taxpayer allocates the lowest cost tax units to the most recently acquired coins.

Note: Allocation is simply a matter of updating records. You don’t need to physically transfer units from one exchange to another to allocate unused basis.

Allocation impact on taxable gains

To further illustrate the allocation’s impact, imagine that the taxpayer sells the following assets in early 2025.

- March 1, 2025: 2 LINK sold from Coinbase at $50 each, totaling $100.

- March 1, 2025: 5 LINK sold from Binance at $50 each, totaling $250.

Assume that the taxpayer does not make any type of standing order or instruction to be able to use specific identification, and therefore, all sales are accounted for on a FIFO basis by the broker. The taxpayer’s tax basis used for these transactions would depend on the allocation as seen below:

Specific unit allocation

Coinbase

- Using the FIFO cost basis method, the 2 LINK units sold from Coinbase for $100 are:

- 1 unit from the unused tax basis at $3 per unit (acquired July 1, 2019).

- 1 unit from the unused tax basis at $15 per unit (acquired September 1, 2020).

- Total tax basis used: ($3 + $15) = $18

- Taxable gain: $100 - $18 = $82

Binance

- Using the FIFO cost basis method, the 5 LINK units sold from Binance for $250 are:

- 4 units from the unused tax basis at $3 per unit (acquired July 1, 2019).

- 1 unit from the unused tax basis at $15 per unit (acquired September 1, 2020).

- Total tax basis used: ((4 x $3) + $15) = $27

- Taxable gain: $250 - $27 = $223

Global allocation

Coinbase

- Using the FIFO cost basis method, the 2 LINK units sold from Coinbase for $100 are:

- 2 units from the unused tax basis at $15 per unit (acquired September 1, 2020).

- Total tax basis used: (2 x $15) = $30

- Taxable gain: $100 - $30 = $70

Binance

- Using the FIFO cost basis method, the 5 LINK units sold from Binance for $250 are:

- 5 units from the unused tax basis at $3 per unit (acquired July 1, 2019).

- Total tax basis used: (5 x $3) = $15

- Taxable gain: $250 - $15 = $235

Final thoughts

Understanding the distinctions between the Specific and Global Allocation methods is essential as you transition to Per-Wallet cost basis tracking under the new IRS regulations. Each method offers unique advantages: Specific Allocation allows for greater flexibility and precision, while Global Allocation provides a more straightforward and uniform approach. Moreover, Specific or Global allocation can be paired with accounting methods like HIFO, LIFO, and FIFO (as long as the brokers offer these). This could also impact your gains and losses when you sell the updated lots.

Choosing the right method depends on your individual circumstances, including your transaction history, number of wallets, and tax strategy. Whichever method you select, it’s crucial to maintain detailed records and ensure your allocations are properly documented to qualify for the IRS safe harbor protection.

To stay compliant, begin reconciling your accounts as soon as possible and follow the steps in Compulsory Universal to Per-Wallet tracking method switch for your crypto - Rev. Proc. 2024-24. For complex situations or additional guidance, consult your tax advisor.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.