Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Updates to Multi-Collateral Dai and How to Account for Dai Interest on Your Crypto Taxes

With multi-collateral Dai, you can deposit Dai into a DSR smart contract to earn additional Dai as interest.

November 26, 2019 · 3 min read

Maker DAO Platform

The Maker platform has become the market leader of decentralized finance (DeFi) with their decentralized stablecoin. Dai now accounts for over 50% of the money locked in DeFi. Other impressive feats of the Maker platform:

- $100M+ worth of Dai in circulation

- Addresses holding Dai is growing 27% MoM on average

- 400+ active Dai integration partners (ranging from global payments and remittance systems to esports and gaming)

- Maker Dao Single-Collateral to Multi-Collateral Transition

For the past few years, the Dai stablecoin was only backed by ether (ETH). On November 18, 2019, Maker DAO launched an upgrade to Dai enabling Multi-Collateral Dai (MCD). The MCD framework allows Dai to be backed by any Ethereum asset, starting with (in addition to ETH), Basic Attention Token (BAT).

Legacy Dai — which was backed only by ether — has been renamed to “Sai” (single-collateral Dai). Therefore, going forward, “Dai” refers to multi-collateral Dai (MCD). The new Dai allows the holder to earn interest simply by holding Dai.

Note: if you held Dai before November 18th, 2019 (Sai), you can upgrade it to Dai to participate in Dai Savings Rate contracts.

How Dai Savings Rate Works

With the launch of multi-collateral Dai, any Dai holder can deposit Dai into the Dai Savings Rate (DSR) smart contract to earn additional Dai (it’s like a savings account for your crypto). You will earn interest income in additional Dai. Better yet, you as the user can withdraw your Dai at any time 24/7 and there is no deposit minimum, fees, or withdrawal limits for your Dai.

DSR Example

Let’s say Judy deposits 100 Dai into the Dai Savings Rate contract account. The Dai Savings Rate contract account offers 5% annual interest. After 12 months, Judy will earn 5 Dai (100 Dai * 5%) as interest income.

If two months in, Judy needs liquidity, she can withdraw her Dai at any time for no penalty (she will simply earn the amount of interest Dai she has accumulated until that point).

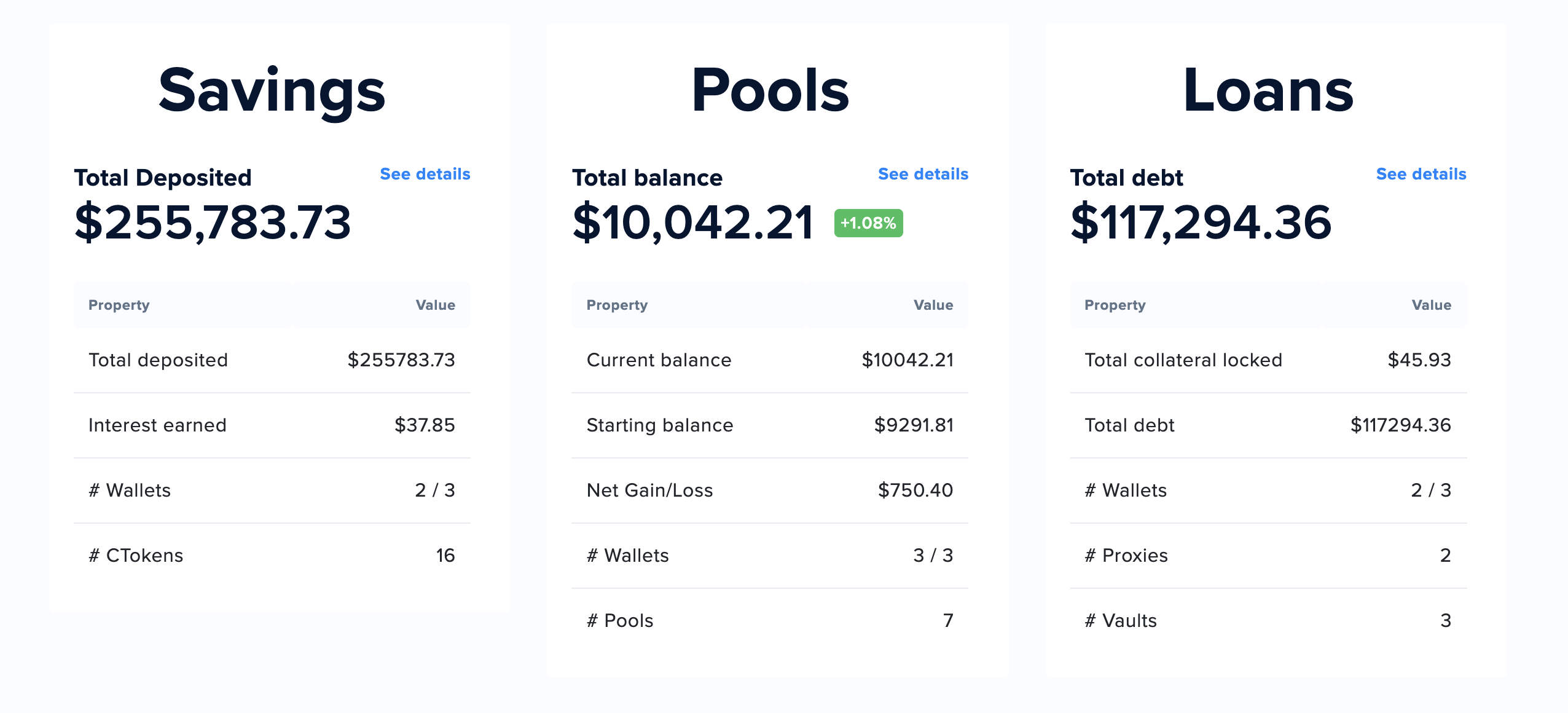

CoinTracker's new DeFi Center automatically tracks your Dai savings accounts, interest income along with your other DeFi pools and loans.

Crypto Taxes on Dai Interest

According to the IRS tax code, interest income is taxable. Annual interest income received from Dai in a DSR is reported on IRS form Schedule B, Part I. The amount of interest income to be recognized is the fair market value of Dai in USD. The amount is similar to the number of Dai received because Dai is a stablecoin, but you can use a cryptocurrency portfolio tracker like CoinTracker to calculate the exact basis for tax purposes given the minor fluctuations in Dai price.

Dai Savings Rate users can — at any time — withdraw their Dai from the contract, along with the interest earned up to that point. Depositing and withdrawing Dai into/from the DSR contract are not taxable events. Interest earned through the end of the tax year is taxed as interest income (regardless of whether it is withdrawn or not). Luckily, CoinTracker will make this easy for users by tracking your interest income for you each year.

In addition to regular income taxes, total interest income received from DSRs and other sources may also be subject to an additional 3.8% Net Investment Income tax if you exceed certain income thresholds.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.