Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

The IRS is Sending Another Round of Crypto Tax Warning Letters

The IRS has started sending out a new round of cryptocurrency tax warning letters in August 2020. Here's what you need to know if you're a US crypto holder.

August 26, 2020 · 2 min read

It has come to our attention from CoinTracker users that the IRS has starting sending out another wave of cryptocurrency tax warning letters to US crypto users.

Received 6174-A from IRS recently. Worried on how to proceed ? from tax

If you ever received an IRS letter about cryptocurrency, can you explain what happened? from Bitcoin

Anyone receive IRS letter recently? from Bitcoin

Received a notice from the IRS stating they have information to believe I didn't declare my crypto or virtual currency and must amend my tax returns, but I don't own any crypto from personalfinance

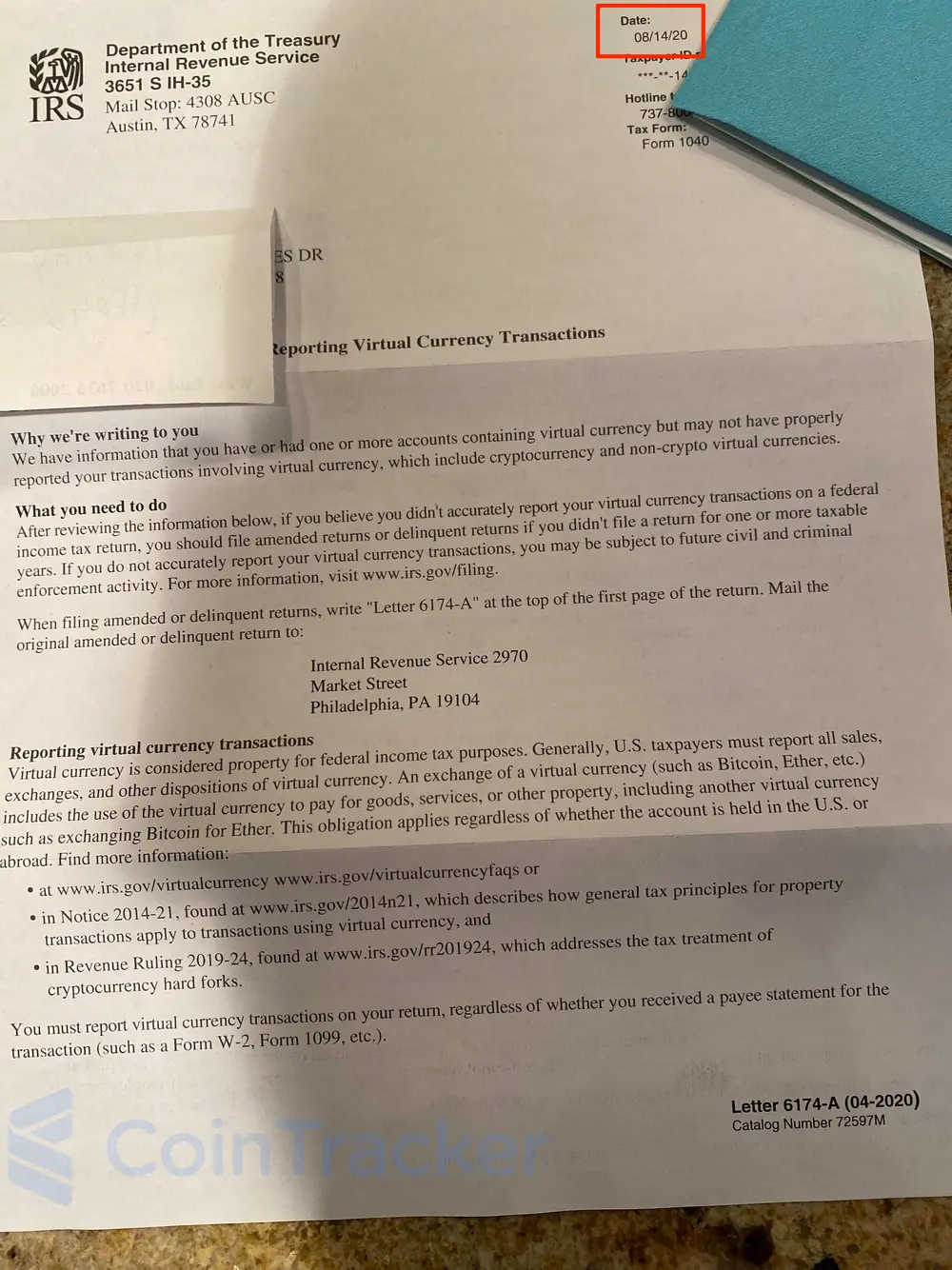

The IRS first started sending out these warning letters in 2019 to 10,000 US crypto users. These notices came out in three variations: IRS Letter 6173, IRS Letter 6174, IRS Letter 6174-A.

IRS Letter 6173

The 6173 letter is the most serious amongst the three. It requires the taxpayer’s response by the date mentioned in the letter. If the taxpayer does not respond, their tax account will be examined by the IRS.

Taxpayers can respond to this letter in following ways:

- File the missing tax return with their virtual currency transactions.

- If they filed a tax return but mistakenly did not report cryptocurrency gains and/or incorrectly reported them, they can amend that return.

- If you think you filed your crypto taxes correctly, you should respond to the letter by attaching a detailed explanation of how you arrived at the income reported.

IRS Letters 6174 and 6174-A

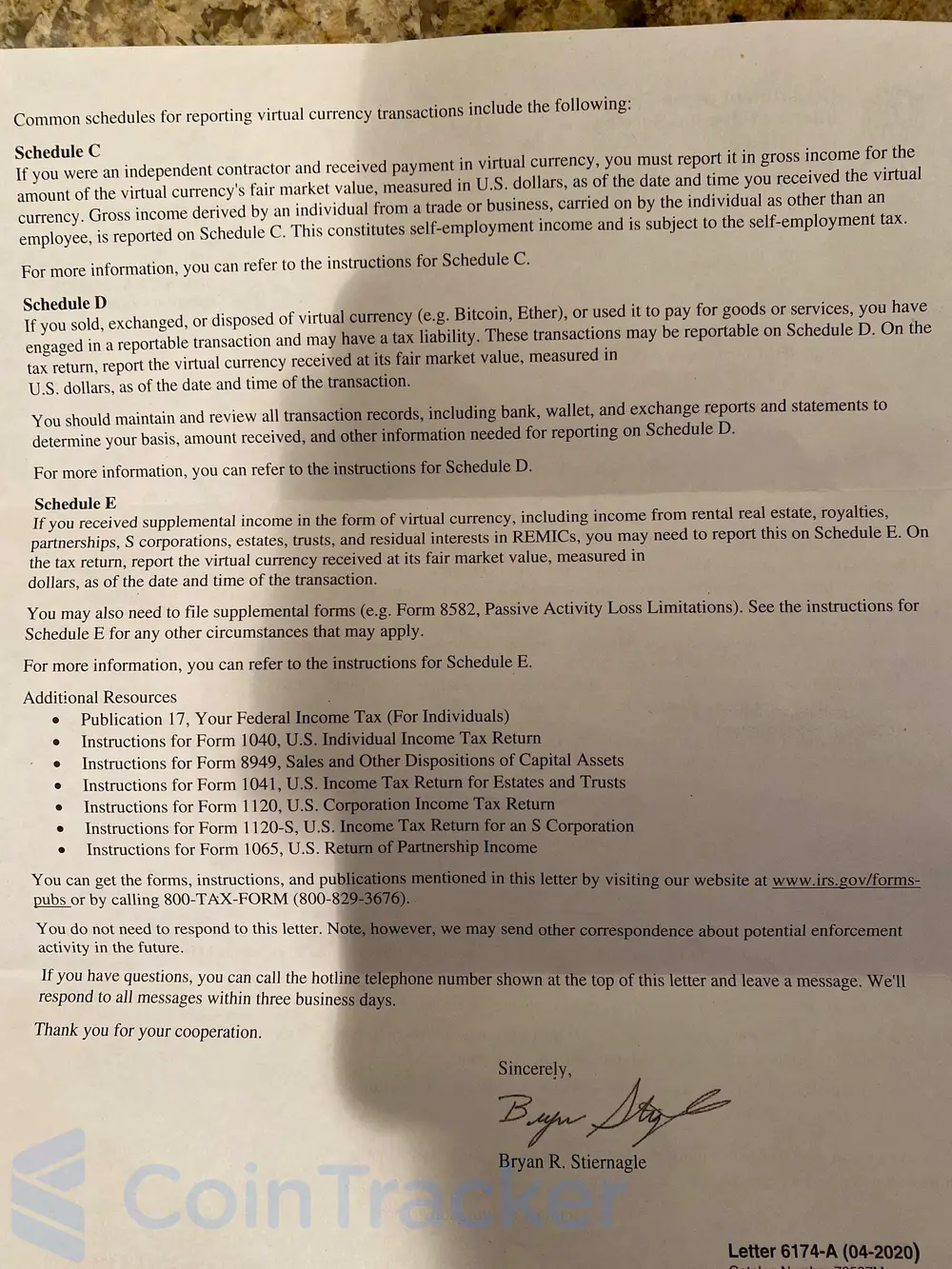

Letters 6174 and 6174-A are no action letters. These are meant to educate the recipient. These letters alert the taxpayer about crypto tax filing obligations and show relevant forms, schedules, and additional IRS resources. After reviewing the information, if the taxpayer thinks they have misreported, underreported, or completely omitted crypto transactions from their previous tax returns, they should file an amended (or delinquent) tax return and write “Letter-6174” or “Letter- 6174-A” at the top.

CoinTracker is here to help you with crypto tax warning letters. If you are still unsure about what exactly you need to do to deal with the crypto warning letter you received, here is a step-by-step guide on how to deal with IRS crypto warning letters.

CoinTracker helps you calculate your crypto taxes by seamlessly connecting to your exchanges and wallets. Questions or comments? Reach out to us @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.