Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Cryptocurrency Tax Write-Off Guide

July 13, 2022 · 23 min read

With recent events like the collapse of FTX, Terra Luna & TerraUSD (UST) coins, and Celsius, Voyager, and other platforms pausing withdrawals, many investors are wondering what their options are for taking tax write-offs.

Tax write-offs can save you thousands of dollars in taxes. However, if you don’t handle them correctly, you will easily increase your chances of being audited by the IRS. Knowing how these write-offs work and when to apply them properly will help you avoid such pitfalls.

Let’s dive into the options for writing off various crypto losses on your tax return.

Capital Losses

A capital loss occurs when there is a “sale or exchange” of a “capital asset” at a loss (Code Sec. 1222(2) and Code Sec. 1222(4)). Most cryptocurrency losses related to trading activities such as cashing out and crypto-to-crypto trades result in capital losses for tax purposes.

For example, say you have 1 bitcoin (BTC) purchased at $50,000. You sold this for $40,000. You now have a $10,000 capital loss ($40,000 - $50,000). The $10,000 capital loss is considered “realized” because you disposed of the bitcoin in exchange for cash (or another coin) at a price lower than what you paid for the bitcoin.

There are two types of capital losses: short-term capital losses & long-term capital losses. Short-term capital losses occur when you sell a coin or an NFT after holding it for less than 12 months. Long-term capital losses occur when you sell a coin or an NFT after holding it for more than 12 months.

You can use capital losses to offset your capital gains. You can offset an unlimited amount of capital losses as long as you have enough capital gains to absorb those losses. However, the tax code only allows you to deduct a maximum of $3,000 net capital loss in any given year.

Going with our example above, assuming you had no other capital gains in the year, out of the total $10,000 capital loss, you can only deduct $3,000 of capital losses in the current year. The remaining $7,000 ($10,000 - $3,000) is carried forward to future years indefinitely. You can use these carried-forward capital losses to offset future capital gains.

Alternatively, assume you have a $12,000 capital gain in the current year. You can use the entire $10,000 capital loss to offset your capital gain. After offsetting, you will pay taxes on $2,000 ($12,000 - $10,000) of net capital gains.

How to report capital losses on crypto?

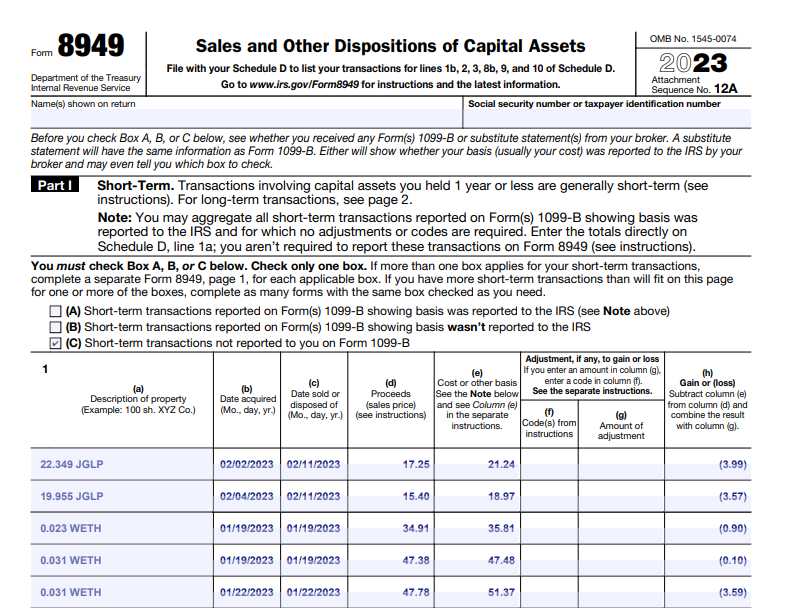

Capital losses are reported on Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses). To do this:

- Collect your transaction history across all your wallets and exchanges.

- Compute your gains and losses.

- Fill out IRS Form 8949 and Schedule D with your transactions.

You can also use CoinTracker to generate cryptocurrency capital gain/loss forms easily.

Can you use the Nonbusiness bad debt loss deduction with crypto?

A nonbusiness bad debt (§166(d)(2)) is a loss from the total worthlessness of a debt you extended to another party like a cryptocurrency exchange or a lending platform. If your debt becomes totally worthless, you can deduct the initial value of the loan as a short-term capital loss on Form 8949.

The highlighted terms are very important. First, the debt must be totally worthless to be deductible under this provision. Generally speaking, debt is totally uncollectible and therefore worthless after you have tried every reasonable way to collect on it and have been unsuccessful. It’s also deemed worthless if the borrower files for bankruptcy and the debt is discharged.

Second, you can only apply the nonbusiness bad debt deduction to debt instruments. This means loans in simple terms. This specific deduction can not be applied to non-debt instruments like stocks, commodities, coins, and tokens.

If you look into the terms & conditions of platforms like Celsius, it is clear that you have lent your coins to the platform to earn yield creating a debt instrument.

However, it is not always very clear to understand what kind of instrument you have with the platform in question. You can look into the terms & conditions and website language to determine if it’s a debt instrument or not. If it is debt, it may be eligible for the nonbusiness bad debt deduction when/if it becomes totally worthless.

As mentioned above, you can write off nonbusiness bad debts only when they are totally worthless. Since most platforms are actively or reportedly working on restructuring and obtaining credit lines to resume withdrawals, it is unlikely that most debts are totally uncollectible & worthless at the moment. A full recovery and/or a partial recovery of your funds may still be possible.

However, If your debt becomes totally worthless, you can deduct the initial value of it (basis).

For example, say John purchased 1 bitcoin (BTC) for $10,000 a few years ago. In 2022, he loans this BTC to platform X to earn a 5% yield. At the time he loans the BTC to X, it is worth $50,000. The platform goes bankrupt and John’s debt becomes totally worthless. Here, John's nonbusiness bad debt deduction is $10,000.

Since nonbusiness bad debts are treated as short-term capital losses, out of the total $10,000 nonbusiness bad debt, he can only deduct $3,000 in 2022, if he doesn't have any other capital gains in the year. He can carry forward the remaining $7,000 ($10,000 - $3,000) to offset future capital gains.

Loss on deposits

Although the nonbusiness bad debt deduction strictly applies to totally worthless debt (as described above), in some rare cases, it can be applied to non-debt-like assets like your deposits lost in a bankruptcy or insolvency of a financial institution (Publication 547). The term “deposit” means any deposit, withdrawable account, or withdrawable or repurchasable share (§165(I)(4)).

Loss on deposit is an obscure type of loss that can be deducted in three ways ‒ a personal casualty loss, an ordinary loss generated by a transaction entered into for a profit (capped at $20,000 for married couples), or a nonbusiness bad debt. Unfortunately, the Tax Cuts & Jobs Act (TCJA) disallowed applying the first two options between January 1, 2018, and December 31, 2025. Therefore, between January 1, 2018, and December 31, 2025, the only effective option for you to deduct such losses is under the bad debt deduction.

Applying this deduction to crypto-assets lost in an exchange bankruptcy or insolvency is not completely free from any ambiguity. First, you must incur a loss in a “qualified financial institution” (§165(I)(3)). According to the definition, qualified financial institutions include banks and other financial institutions charted and supervised under Federal or State law. Most cryptocurrency exchanges like FTX and lending platforms may fail to satisfy this definition (although they function like financial institutions). However, If you are dealing with a qualified financial institution and your crypto assets are lost as a result of bankruptcy or insolvency of that institution, you may be eligible to deduct that loss as a nonbusiness bad debt.

(If the loss on deposit can not be deducted as nonbusiness bad debt, you may be able to deduct them as a casualty loss related to an income-producing property based on facts & circumstances of your case. See below.)

We highly recommend talking to your tax advisor to determine if you are eligible to take a deduction under this approach and if it’s even worth doing so in your particular case.

How to report nonbusiness bad debt deduction

You can report a nonbusiness bad debt as a short-term capital loss (Code Sec. 166(d)(1)(B)) on Form 8949 (Sales and Other Dispositions of Capital Assets), Part 1, line 1, and check box (C), “Short-term transactions not reported to you on Form 1099-B”, in the year it becomes totally worthless. The amount you can deduct is the initial value of your investment (cost basis).

Since this is a nonbusiness bad debt deduction, you will also have to attach some additional paperwork (a bad debt statement) to your tax return.

The bad debt statement must contain the following:

- A description of the debt, including the amount and the date it became due.

- The name of the debtor, and any business or family relationship between you and the debtor.

- The efforts you made to collect the debt.

- Why you decided the debt was worthless.

Bad Debt Statement Example:

John Doe - Social Security Number: 123-45-6789

Description of Debt: 1 bitcoin

Debt Amount: $10,000 (Total amount owed)

Due Date: On-Demand

Name of Debtor: Platform X

Relationship: Unrelated third party

Efforts made to collect this debt: Made several attempts (explain and attach logs) to withdraw funds but failed.

Why this debt was worthless: Company declared bankruptcy on dd/mm/yyyy. Therefore, $10,000 is totally uncollectible and therefore worthless.

One important thing to note is that if you deduct the bad debt and in a later tax year you collect all or part of it, you may have to include the amount you recovered in your gross income and pay taxes.

How to use casualty & theft losses for crypto

Before we dive deep into how you can deduct casualty and theft losses, it is important to understand some background.

The Tax Cuts & Jobs Act (TCJA) passed in 2017, significantly reduced your ability to write off personal losses on your taxes. Consequently, between January 1, 2018, and December 31, 2025, casualty & theft losses are deductible only if they are attributable to a federally declared disaster area. These losses typically include damages caused to your physical property by natural events such as floods, hurricanes, etc. Cryptocurrency-related casualty and theft losses are quite hard to deduct under this rule because it’s difficult to attribute those losses to federally declared disaster areas.

What is “A transaction entered into for a profit”?

Luckily, the tax code still allows you to deduct casualty & theft losses (not attributable to federally declared disaster areas) if you incur them in a “transaction entered into for a profit” (§165(c)(2)). Notably, these losses were not prohibited by the TCJA.

There’s no clear guidance on what constitutes a “transaction entered into for a profit”. This phrase is subject to interpretation and generally determined based on the facts and circumstances of each case. Based on past court cases, generally speaking, to have a “transaction entered into for a profit”, you must enter into a transaction primarily to make profits and you must have an actual “transaction”. The term “transaction” is defined differently throughout history. It is conservative to assume that you should incur a loss in the exact transaction you are entered into making a profit to be eligible for a deductible.

Knowing these nuances is crucial before we analyze the deductibility of cryptocurrency-related casualty and theft losses.

Casualty Losses

Casualty losses result from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event not willfully caused by you.

A sudden event is one that is swift, not gradual or progressive. An unexpected event is one that is ordinarily unanticipated and unintended. An unusual event is one that isn’t a day-to-day occurrence and that isn’t typical of the activity in which you were engaged. Let’s apply this to a cryptocurrency-related incident.

For example, mistakenly sending funds to an incorrect address or genuinely losing access to your private keys (not a “boating accident”) are cryptocurrency-related casualty losses because they result in a loss of property (your crypto assets) due to a sudden, unexpected, or unusual event not willfully caused by you.

As mentioned above, these types of casualty losses are technically deductible if they occur in a “transaction entered into for a profit” (transaction entered into for a profit test). However, practically speaking, in most cases, It is quite difficult to prove that these losses occur in the exact transaction you entered into for a profit, and/or your motivation behind the transaction is primarily profit. As a result, most cryptocurrency-related casualty losses fail to meet the “transaction entered into for a profit” test making them nondeductible.

For example, say you wanted to transfer funds from a centralized exchange to your self-custody wallet to store them securely. Unfortunately, you sent the funds to an incorrect wallet address. Here, you clearly have a casualty loss but it is NOT connected to a “transaction entered into for a profit” because you didn’t enter into the transfer transaction to primarily make profits; you wanted to safeguard your assets.

Thus, it is safe to think that cryptocurrency-related casualty losses are not tax-deductible in 99% of cases because they fail to confidently meet the ambiguous “transaction entered into for a profit” test. There could be rare situations where such losses may be deductible.

How to report deductible crypto casualty losses?

If you believe you have a deductible cryptocurrency-related casualty loss, you can use Form 4684, Section B, Part II to report such losses in the year you sustain the loss. That said, you can not take this deduction in the year you sustain the loss if you reasonably believe that you will recover funds through a claim or a reimbursement. The amount of the deduction is your initial investment value.

Also, note that you can only benefit from this deduction if you itemize on your tax return or if your deductible casualty loss is above your annual standard deduction threshold (Single: $12,550, Married filing jointly: $25,100). If you don’t itemize or your deductible loss is below the thresholds above, you can not get any additional tax benefit by claiming these losses on your taxes.

We highly recommend talking to your tax advisor to determine if you are eligible to take a deduction under this approach and if it’s even worth doing so in your particular case.

What are crypto "boating accident" losses

“I lost my crypto in a boating accident” is a fake excuse used by some crypto holders to not pay taxes on certain wallets they own.

Before we talk about the tax implications, it is very important to note that intentionally concealing funds from taxation and misleading regulators have serious legal consequences. Attempting to take any tax deduction for these wallets you “lost” can only make matters worse.

Theft Losses

A theft is the taking and removal of money or property with the intent to deprive the owner of it. The taking must be illegal under the law of the state where it occurred and must have been done with criminal intent.

The TCJA significantly changed to what extent you can deduct theft losses on your taxes.

- Before January 1st, 2018, you could deduct theft losses related to both transactions not entered into for a profit and transactions entered into for profit.

- From January 1st, 2018 to December 31, 2025, you can only deduct theft losses related to transactions entered into for profit.

- After January 31, 2025, you will be back to old rules. You can deduct theft losses related to both transactions not entered into for a profit and transactions entered into for profit.

Theft losses related to transactions not entered into for profit

Most theft losses that occur in day-to-day life are not tax-deductible at the moment because they aren’t related to any transaction entered into for profit.

For example, someone breaks into your car and steals your laptop and money while you are shopping. Although this is clearly a theft loss, it is not tax-deductible between January 1, 2018, to January 31, 2025, because the theft loss occurred in a non-income-producing activity.

Following this fact pattern, if you lose crypto as a result of your exchange account getting hacked is not deductible because you are not entered into a transaction to make a profit at the time of the hack; your cryptocurrency is just sitting on the account.

Theft losses related to transactions entered into for profit

You can strongly argue that most cryptocurrency-related theft losses are tax-deductible if they occur in a transaction entered into for a profit.

Consequently, the following events could lead to deductible theft losses:

- A bad actor misled you to approve a malicious contract and you lost your coins as a result.

- Your wallet and the funds inside were compromised as a result of a phishing attack.

- You were misled to send funds to a fraudster in return for a service or something else you never received.

For example, John has 1 ETH in his MetaMask wallet. The cost basis is $2,000. The market value is $4,000. John attempts to connect his wallet to a protocol that promises to pay 20% APY. In the process, he approves a malicious contract and loses his 1 ETH. Here, John can deduct $2,000 as a theft loss because he clearly incurred this loss in a transaction entered into for a profit.

How to report deductible crypto theft losses?

If you have a deductible theft loss, you can use Form 4684, Section B, Part II to report it. Generally, theft losses are deductible in the year you discover the loss. That said, if you reasonably believe that you can recover the funds through a claim for reimbursement you can not deduct the loss in the year you discover the loss. You have to wait. Here, you can only deduct the loss in the year you can determine with reasonable certainty that you will not receive such reimbursement. The amount of the deduction is your initial investment value.

Also, note that you can only benefit from this deduction if you itemize on your tax return or if your deductible loss is above your annual standard deduction threshold (Single: $12,550, Married filing jointly: $25,100). If you don’t itemize or your deductible loss is below the thresholds above, you can not get any additional tax benefit by claiming theft losses on your taxes.

We highly recommend talking to your tax advisor to determine if you are eligible to take a deduction under this approach and if it’s even worth doing so in your particular case.

Ponzi Scheme Loss Safe Harbor

A Ponzi scheme is a situation where “the party perpetrating the fraud receives cash or property from investors, purports to earn income for the investors, and reports to the investor's income amounts that are wholly or partially fictitious. Payments, if any, of purported income or principal to investors are made from cash or property that other investors invested in the fraudulent arrangement” (Rev. Proc. 2009-20)

Losing your crypto investment to a Ponzi scheme is a type of deductible theft loss (as described above) because it’s a transaction entered into for profit. You can deduct such Ponzi losses as theft losses by relying on the facts & circumstances of your specific case. However, it’s not always easy for taxpayers to analyze the facts & circumstances of each case to determine if it’s a deductible theft loss.

To make taxpayers’ lives easier, in 2009, the IRS introduced an optional streamlined process (known as a safe harbor) to deduct Ponzi losses that meet several clearly-outlined criteria. This process eliminated the facts & circumstances test that taxpayers struggled to apply and made it simpler for taxpayers to identify and deduct Ponzi losses. Most importantly, If your Ponzi loss situation meets the safe harbor criteria, the IRS will not challenge the deduction. This is a huge advantage to taxpayers compared to taking the loss as a regular theft loss connected to a transaction entered into a profit.

For example, if you are a victim of the BitConnect Ponzi scheme, you may be able to apply this safe harbor and deduct the loss.

BitConnect Ponzi scheme losses can be deducted under special safe harbor rules.

To apply for this safe harbor, you need to meet the following criteria:

- Specified fraudulent agreement

A specific fraudulent arrangement is “an arrangement in which a party (the lead figure) receives cash or property from investors; purports to earn income for the investors; reports income amounts to the investors that are partially or wholly fictitious; makes payments, if any, of purported income or principal to some investors from amounts that other investors invested in the fraudulent arrangement; and appropriates some or all of the investors' cash or property - Qualified loss

A qualified loss occurs when the lead figure is charged by indictment or information under state or federal law. This qualification was met when the BitConnect founder was indicted on February 25, 2022, by a jury in San Diego. - Qualified investor with a qualified investment

Any US person in general who contributed cash or property to a specified fraudulent agreement.

Under the safe harbor, you can take the Ponzi loss deduction in the year in which the indictment, information, or complaint was filed (in 2022).

How to report crypto Ponzi scheme losses

Ponzi scheme losses are reported in Form 4684, Section C. You can deduct either 95% or 75% of the loss depending on recovery plans.

Again, note that you can only benefit from this deduction if you itemize on your tax return or if your deductible loss is above your annual standard deduction threshold (Single: $12,550, Married filing jointly: $25,100). If you don’t itemize or your deductible loss is below the thresholds above, you can not get any additional tax benefit by claiming theft losses on your taxes.

We highly recommend talking to your tax advisor to determine if you are eligible to take a deduction under this approach and if it’s even worth doing so in your particular case.

How to report worthless security deductions for crypto

If you own a “security” (defined below) that is now totally worthless, you can take a deduction under this rule. Note that you can not get a deduction if the security is partially worthless.

A “Security” for purposes of this deduction means (§165(g)(2)) —

- a share of stock in a corporation;

- a right to subscribe for, or to receive, a share of stock in a corporation; or

- a bond, debenture, note, or certificate, or other evidence of indebtedness, issued by a corporation or by a government or political subdivision thereof, with interest coupons or in registered form.

Coins and NFTs which have crashed to near-zero values (Ex: Luna) aren't eligible for a write-off as a worthless security deduction because they don't fall under the "security" definition above. IRS CCA 202302011 issued on January 13, 2023, further confirmed this position.

That said, certain ICO tokens classified as a “security” under the above definition which have become totally worthless may be eligible for this deduction. If qualified, you can deduct the initial investment as a capital loss.

For example, in 2017, John invested $5,000 in an ICO project which granted him 1% ownership interest in the company. In 2022, the project is no longer active and the company ceases to exist. John’s tokens are totally worthless and he can deduct $5,000 as a worthless security in his 2022 taxes.

How to report worthless security deductions?

You can use Form 8949 to report worthless securities. Make sure to write “worthless security” on the “description of property” column (a) and enter zero as proceeds on column (d).

Abandonment losses

Certain losses may qualify as an “abandonment loss” based on the facts and circumstances of the specific case. Highlighted sections of the definition below are quite important because they help you determine if you really have an abandonment loss.

Under § 1.165-2 of the tax code, an abandonment loss is “a loss incurred in a business or in a transaction entered into for profit and arising from the sudden termination of the usefulness in such business or transaction of any non-depreciable property, in a case where such business or transaction is discontinued or where such property is permanently discarded from use therein, shall be allowed as a deduction under section 165(a) for the taxable year in which the loss is actually sustained.”

It is important to compare and contrast abandonment losses with other types of losses we discussed above. Although abandonment losses share some characteristics with casualty losses (mainly “sudden” in nature), your intentional act is typically required to “permanently discard” the asset from use and trigger an abandonment loss. On the other hand, casualty losses occur without your willful intent. An abandonment loss is not theft because there’s no perpetrator illegally taking property from you with criminal intent. An abandonment loss is not a capital loss because it lacks a “sale or exchange”; abandoning a property is a one-way transaction, not an exchange.

In simple terms, to confirm whether you qualify for an abandonment loss, ask yourself these questions with regard to the cryptocurrency you are holding that has gone to zero:

- Did you invest with the intention of making a profit?

- Did the cryptocurrency suddenly stop being valuable?

- Is it a non-depreciable property? (yes: all cryptocurrencies are non-depreciable property)

- Did you permanently discard the worthless coins? (e.g. for example sending them to a null address?)

If you answer “Yes” to all of the above questions, you could treat your loss as an abandonment loss. Make sure you document the answers to these questions along with proof of your ownership of coins prior to abandonment, an intent to abandon the coins, and the actions you took to abandon the property (three-prong test set by the tax courts). These records will come in handy in case the IRS questions your deduction.

Let’s use an example to apply these rules. Say Sam purchased 1,000 ABC coins for $1,000 in 2017. He invested this $1,000 with the intention of cashing out at a much higher price when the mainnet launches in 2019. In 2021, ABC announces that the project has stalled, and there is no chance of a mainnet launch. Online research and other third parties confirm that the project is abandoned without any prior notice. Further, there’s no active market to sell ABC coins which are now worthless. Sam sends 1,000 ABC coins to a null address to cease ownership of ABC.

Answering the following questions can help us figure out if Sam has an abandonment loss:

- Did Sam invest in a cryptocurrency with the intention of making a profit?

Yes, he wanted to cash out and make profits once the mainnet was launched. - Did Sam experience a sudden termination of the usefulness in such a business or transaction?

Yes, in 2021 Sam realized that there is no active market for ABC because the project failed. Online research and other third parties also confirmed this. - Is cryptocurrency a non-depreciable property?

Yes, cryptocurrencies are non-depreciable property. - Did Sam permanently discard the coins from the use by sending them to a null address?

In 2021, Sam sent the coins to a null address so he could prove that he permanently discarded the coins.

This example lays out a good fact pattern that would make you eligible for an abandonment loss.

The following examples show when you can not take an abandonment loss (although you might see it as such on the surface):

- Sam’s investment in the ABC coin drops by 99.9%. However, Sam still holds the coin with the expectation of the price going up in the future. Here, Sam can not take an abandonment loss because he still holds the coins. He has not permanently discarded the coins to trigger an abandonment loss.

(Note: IRS CCA 202302011 which was issued on January 13, 2023, further reaffirmed the importance of taking an action to permanently discard the coin. Without such an action, the coin is not abandoned and therefore, not eligible for an abandonment loss deduction) - Assume the same facts as above. To trigger an abandonment loss, Sam sends the ABC coins to a null address. However, the coin value has not gone down to absolute zero and there are markets where he can sell the position for a very small value. In this case, taking an abandonment loss would not be appropriate. Sam should take a capital loss by selling the coin and receive a small value in return.

- Assume the same facts as above. To trigger an abandonment loss, Sam sends the ABC coins to a null address. However, he later buys back the same coins because he believes there’s an upside to holding the coin. In this case, Sam didn’t truly abandon the coin because he didn't permanently discard the coins.

How do I report abandonment losses for crypto?

Abandonment losses are reported on Form 4797, line 10 in the year you incur the loss or you ceased ownership of the coins permanently. The amount of the deduction is your initial investment value (Cost basis).

Abandonment losses are subject to fewer restrictions when it comes to deducting compared to other losses we discussed above. These losses are considered ordinary losses and are not subject to capital loss limitation rules. Further, you can take a tax benefit even if you don’t itemize on your tax return. Since this deduction is more tax advantageous, you can become an easy target for the IRS if you deduct a substantial amount (even when you do so properly). Having detailed records and documentation are always critical when defending a stance with the IRS, and nothing is guaranteed.

We highly recommend talking to your tax advisor to determine if you are eligible to take a deduction under this approach and if it’s even worth doing so in your particular case.

Be careful when taking tax write-offs

It is important to know what the final outcome is before taking any write-offs on your tax return. For example, Mt Gox was a crypto exchange that went bankrupt in 2014. Users are still waiting to find out if and when they will receive recovery funds. For example, Jane had 1 BTC on the Mt Gox exchange when it went bankrupt in 2014. 1 BTC has a cost basis of $10. It is still unclear what Jane will receive in 2022. Jane can’t deduct the 1 BTC in 2014 or any subsequent year. Now let us assume in 2023 it is confirmed that Jane will not receive any recovery funds. She will be able to report a $10 loss on her 2023 tax return.

Waiting until the final determination is important because if you report a loss in 2014 and receive funds in 2023 the funds received will be taxable income in 2023.

Apart from regular capital losses, you must be extremely cautious when taking less frequently used write-offs such as nonbusiness bad debt, casualty losses, theft losses, worthless security deductions, and abandonment losses. If you don’t handle them correctly, you will definitely increase your chances of being audited. Even when handled correctly, the IRS may still question your position because your tax return pops up from the majority of returns with no special deductions. In many cases, the overall cost associated with audits and correspondence with the IRS could outweigh the tax savings you get from obscure write-offs. Therefore, consult with your tax advisor to evaluate the pros and cons before committing to some of these write-offs.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker. We’re also hiring across the organization — join us!

CoinTracker integrates with 400+ cryptocurrency exchanges, and 8,000+ cryptocurrencies, and makes crypto tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.