Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Save Big with Cryptocurrency Tax Loss Harvesting

November 28, 2018 · 5 min read

As the end of the year approaches, we at CoinTracker want to encourage you to begin thinking about tax-efficient strategies for your crypto assets. We all know that 2018 has not been the best year for crypto.

But fear not… there is a silver lining!

In this series, we will review three strategies you can employ to help decrease your 2018 tax liability. The first strategy we discuss is tax loss harvesting, which allows you to take advantage of unrealized losses in your portfolio to minimize the taxes you’ll owe in 2018.

We’ll continue this series over the next couple of weeks, so stay tuned!

Tax Loss Harvesting

So what is tax loss harvesting anyway?

Tax loss harvesting is a strategy whereby you sell underwater portfolio holdings in order to generate realized losses that can offset realized gains, decreasing your overall tax bill.

Sounds great, but how does it actually work?

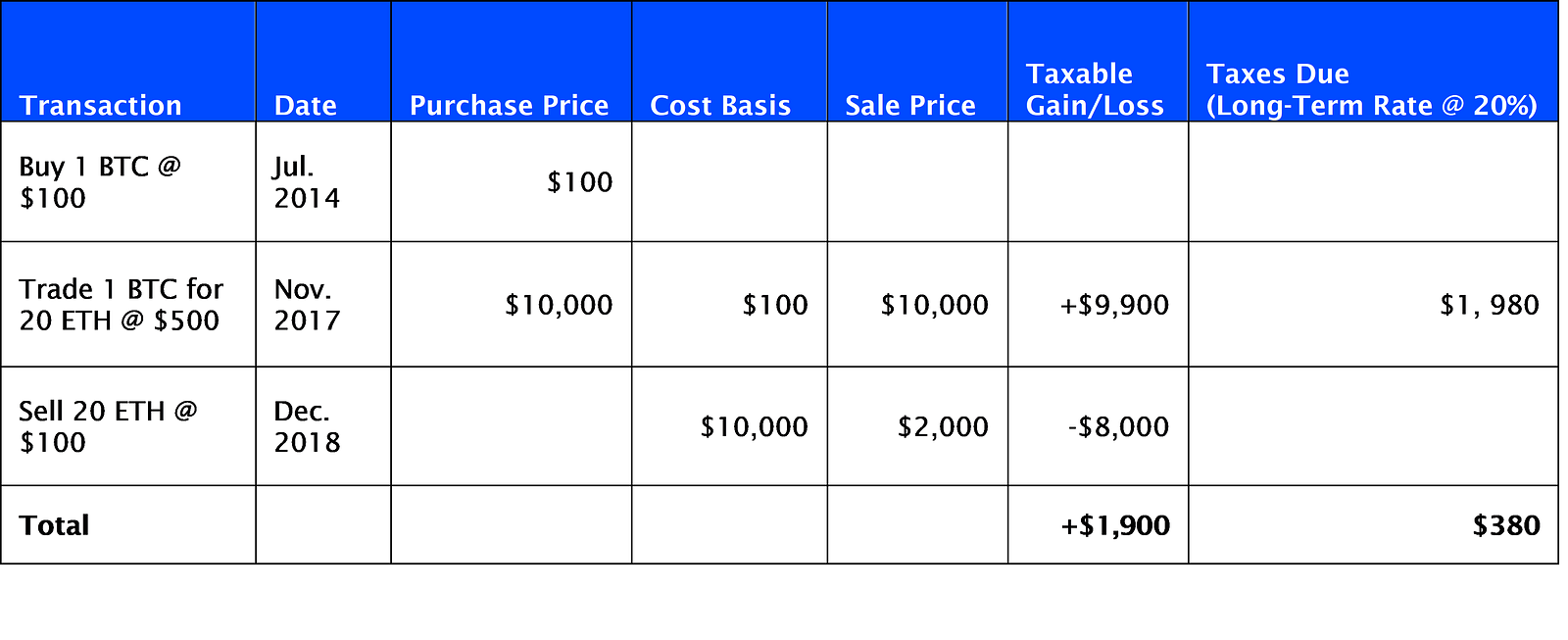

Say you purchased 1 BTC back in 2014 for $100. In November 2017, you exchanged your 1 BTC (worth $10,000 at the time) for 20 ETH at $500 each (also worth $10,000). This trade from BTC to ETH is a taxable event and creates a capital gain of $9,900 on your BTC ($10,000 “sale” price minus $100 purchase price).

It is now December 2018 and you are still holding your 20 ETH, which have fallen in value from $500 to $100 each (a drop from $10,000 to $2,000 in total). And you still have to pay taxes on your $9,900 BTC gain!

But wait! Thanks to tax loss harvesting, you may be able to lower that capital gain. If you sell or trade your 20 ETH, you will realize a capital loss of $8,000 ($2,000 sale price minus $10,000 purchase price). This loss can offset your capital gain. Now you will pay taxes on a smaller net gain of $1,900 ($9,900 gain minus $8,000 loss). This is tax loss harvesting. You “harvest” losses in your portfolio to help minimize the taxes you incur.

Now that we understand the basics, let’s dig into some nuances…

In the case above, you held both your BTC and ETH for more than 12 months, so you will be taxed at the long-term capital gains tax rate. But if you had sold your holdings within 12 months of acquisition, you would be taxed at the short-term capital gains tax rate. When deducting capital losses from capital gains, “like for like” gains/losses first offset one another, then remaining losses can be applied to the other category of gains.

For example: first, a short-term loss will be deducted against a short-term gain and same for a long-term loss against a long-term gain. If there are short-term losses leftover, they will then be applied to long-term gains, and vice versa. This is an important detail because long-term capital gains tax rates are different from short-term capital gains tax rates. Typically, short-term gain rates are higher, so short-term gains will be more beneficial to offset, if possible.

Keep in mind that that capital gains and losses from all of your investments (stocks, bonds, crypto, etc.) are considered together. Losses from crypto are applied to gains in a traditional stock portfolio (and vice versa). So if, for example, you only have long-term capital gains in your crypto portfolio, but you have short-term gains in your stock portfolio, short-term crypto losses will first offset your short-term stock gains. If all short-term gains are completely offset and any short-term losses remain, they are then applied to your long-term gains.

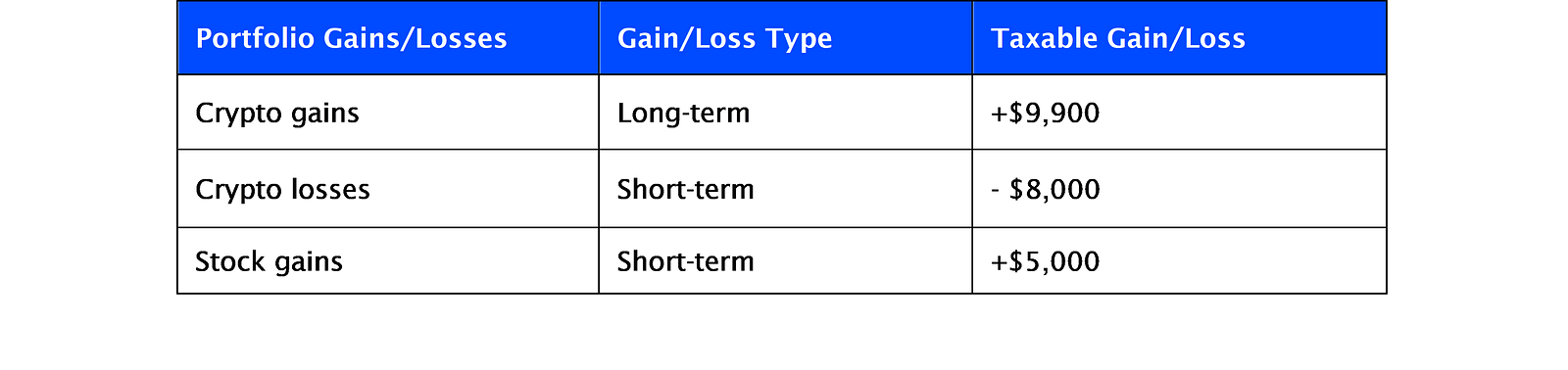

Consider the example above with additional transactions from a stock portfolio:

First, the short-term crypto losses offset the short-term stock gains, resulting in $0 of overall short-term capital gain. Then, the remaining $3,000 short-term loss ($8,000 minus $5,000) is applied to the $9,900 long-term crypto capital gain.

Why does tax loss harvesting sound so familiar?

Tax loss harvesting is not specific to crypto. You have probably heard about it as it relates to your traditional investments as well. However, there is one important difference!

When implementing tax loss harvesting in a traditional securities portfolio, it is important to consider the wash sale rule. This rule states that you must wait at least 30 days before repurchasing the same or substantially identical security to the one that you sold in order to generate a realized loss. Otherwise, the sale is considered a “wash” and you are not allowed to claim the capital loss from the sale.

Interestingly, in some geographies, the wash sale rule does not apply to certain crypto assets. In the US, for example, the wash sale rule applies only to securities, and BTC is not a security. This means that if you sell your BTC to incur a capital loss, you can choose to repurchase it immediately after selling it. In this way, your portfolio remains unchanged but you pay fewer taxes.

A few warnings regarding non-applicability of wash sales to crypto:

1) The sale and repurchase of a crypto asset will reset your capital gains clock, regardless of how long ago you initially purchased the asset. You will have to wait 12 months from repurchase if you want to incur long-term gains upon the next sale.

2) Although BTC is not a security, and as such, not subject to wash sale rules, other crypto assets may be considered securities and would be subject to wash sale restrictions. If you do engage in a wash sale with a crypto asset that is a security, you will not reap the tax benefit of harvesting the loss.

NOTE: You can still apply the tax loss harvesting technique while maintaining your portfolio even with tokens that are considered securities if you wait the full 30-day period before repurchasing them into your portfolio.

If you want to use tax loss harvesting to minimize your taxes for the 2018 tax year, you must make the relevant trades before December 31, 2018.

What kind of features would you like CoinTracker to implement around tax loss harvesting? Are there any other tax efficient strategies you’d like us to write about? Tweet @cointracker or let us know in the comments!

And look out for our next article on other tax minimization strategies next week.

See the follow-up article on how to use CoinTracker to tax loss harvest your cryptocurrency portfolio.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.