Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

IRS Updates the Crypto Question on 2022 Draft Form 1040

The latest draft of IRS Form 1040 for 2022 has an updated question about cryptocurrencies. Find out if you need to report crypto on your taxes.

September 17, 2022 · 3 min read

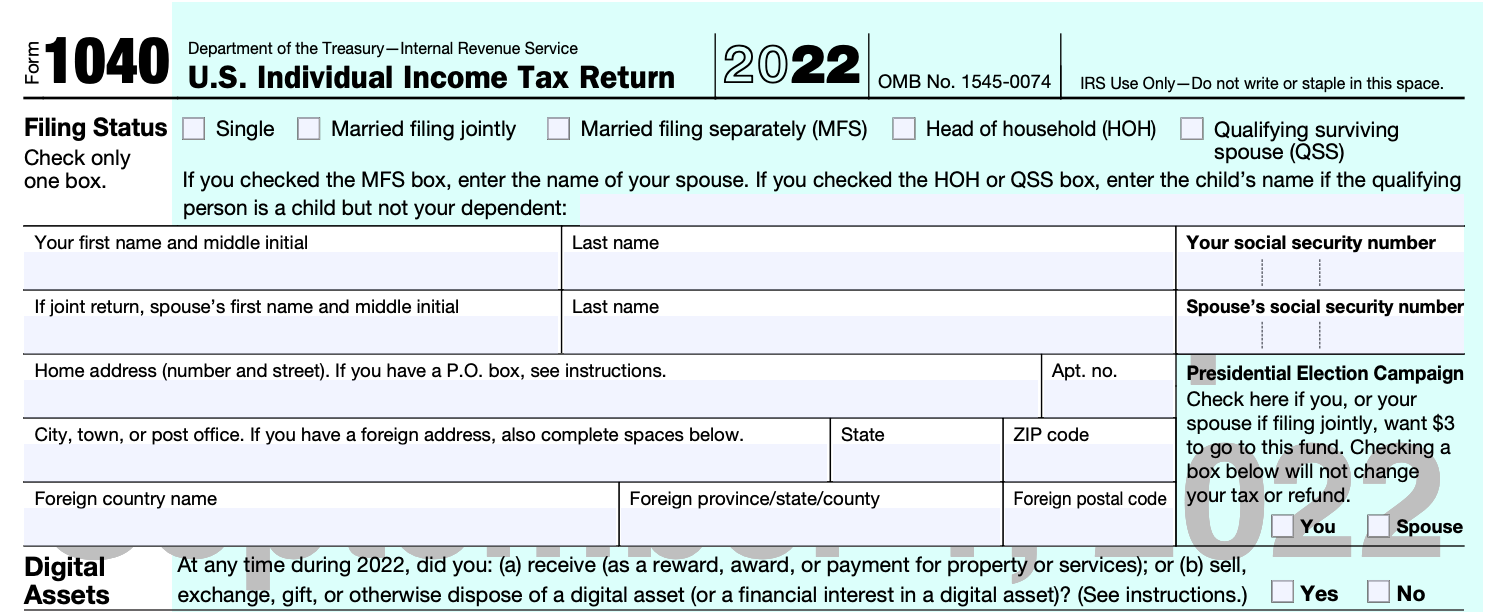

The IRS continues to refine and update their question regarding cryptocurrencies. The draft Form 1040 for 2022, released September 1, 2022, shows the newest version of the cryptocurrency question. Below you can see the evolution of the question between 2022 and 2021.

In 2022 the IRS seems to be taking a more direct approach than in 2021 by further defining the terms used in the question.

“At any time during 2022, did you (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

The goal of the question is clear. The IRS is trying to see who has taxable transactions. They revised the receive portion of the question to outline the possible receipt items (rewards, awards, payment). They added “gift” to the face of the return as one of the sent items requiring a yes answer. The other significant change to the question was substituting “virtual currency” with “digital asset.” This change has brought NFTs into the scope of the question.

When you can answer “No” to the digital assets question

The IRS has released draft instructions for the 2022 form. A taxpayer can check “No” for the digital assets question if you:

- Only bought using fiat

- Only Held in wallets purchased in previous years (Hodling)

- Transferred between your own wallets during 2022

When you must answer “Yes” to the digital assets question

You will still have to check “Yes” if you have done with following with digital assets in 2022:

- Received as payment for property or services provided

- Received as a result of a reward or award

- Received as a result of mining, staking, or similar activities

- Received as a result of a hard fork (ex:- ETHW & ETHF after The Merge)

- Disposed of in exchange for property or services

- Disposed of in exchange or trade for another digital asset

- Sold for fiat (ex:- cashing out Bitcoin on Coinbase)

- Gifted to a person or organization

- Otherwise disposed of any other financial interest in a digital asset

Selling crypto into fiat, trading crypto for another crypto, and using crypto to buy goods and services are taxable events and subject to capital gains tax. Receiving crypto as payment, being airdropped NFTs, or receiving any type of reward is subject to income tax. You are responsible for calculating the cost basis and resulting tax liabilities.

Crypto taxes are still ambiguous

Even with the existing instructions provided by the IRS, the guidance is still far from comprehensive. For example, we still don’t know whether a taxpayer who owns Bitcoin through a pass-through entity needs to check “Yes” for the question. The “financial interest” portion of the question is still subject to interpretation.

The 2022 Form 1040 is still a draft. However, it's unlikely to change from its current state by tax season.

If you have any questions or comments about crypto tax and IRS forms, let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 8,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.