Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

Cryptocurrency Buys Are Not Reportable To The IRS

The IRS says bitcoin purchases are not subject to any reporting.

March 3, 2021 · 2 min read

On March 2, 2021, the IRS clarified that buying cryptocurrency with fiat currency, contrary to popular opinion, is not subject to any type of IRS tax reporting (IRS cryptocurrency FAQ Q5):

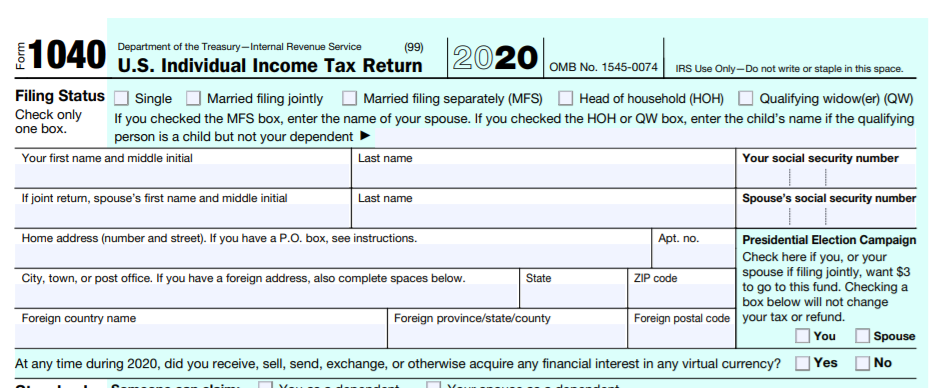

For the first time this year, the IRS has updated Form 1040 to ask American taxpayers: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Previously, this was assumed to include acquiring virtual currency assets with fiat currency (e.g. buying bitcoin with dollars). In reality, the IRS is now clarifying that simply buying cryptocurrency with fiat currency does not require a “yes” check on this form. Of course, other types of cryptocurrency transactions such as selling, trading crypto-to-crypto, etc. would still require a “yes” check.

Note: cryptocurrency holders still need to track the cost basis of the coins they purchased using a tool like CoinTracker. This information is critical to track to calculate capital gains taxes and complete IRS Form 8949 when the coins are later sold.

Prior to this guidance, crypto holders were confused about whether to check “yes” when they purchase cryptocurrency using USD. Given the limited IRS instructions on how to answer this question, some taxpayers checked “yes” even when they purchased cryptocurrency using USD assuming they acquired a “financial interest” in virtual currency. This added guidance from the IRS provides more clarity to taxpayers in answering this question going forward. Further, privacy-focused crypto users would appreciate that they don’t have to disclose their involvement with cryptocurrency to the IRS needlessly.

It’s important to highlight that FAQ Q5 only applies to cryptocurrency purchased with fiat currency (e.g. US dollars). If cryptocurrency is purchased using another cryptocurrency (i.e. crypto-to-crypto trade), the “yes” box on Form 1040 still needs to be checked.

If you have any questions or comments about crypto taxes let us know on Twitter @CoinTracker.

CoinTracker integrates with 300+ cryptocurrency exchanges, 3,000+ blockchains, and makes bitcoin tax calculations and portfolio tracking simple.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.