Are you confident in accurately reporting cryptocurrency earnings on your tax returns?

The IRS is Asking Every American Whether They Own Cryptocurrency in 2020

Starting in 2020, the IRS is going to ask every single american taxpayer for the first time whether they have cryptocurrency on the IRS Form 1040.

August 21, 2020 · 2 min read

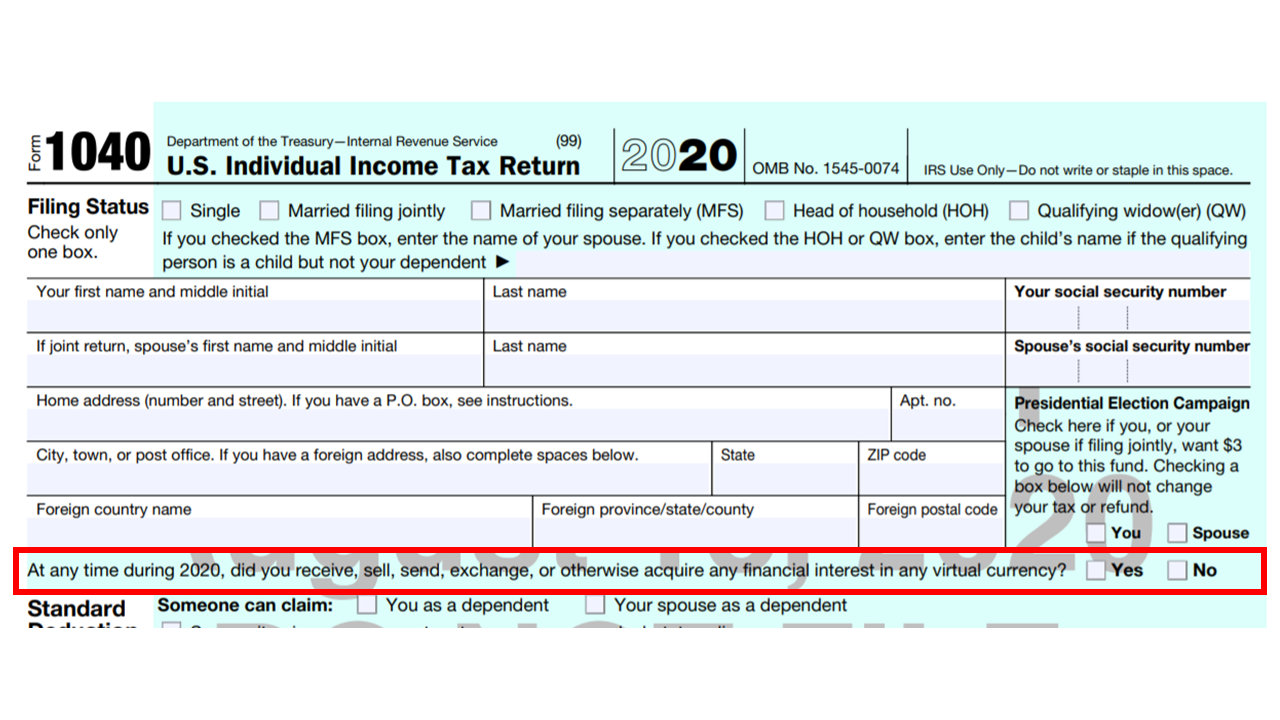

On August 18, 2020, the IRS released draft Form 1040 for the 2020 tax year. As shown in the screenshot below, they have added a virtual currency question for every American taxpayer to answer: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”.

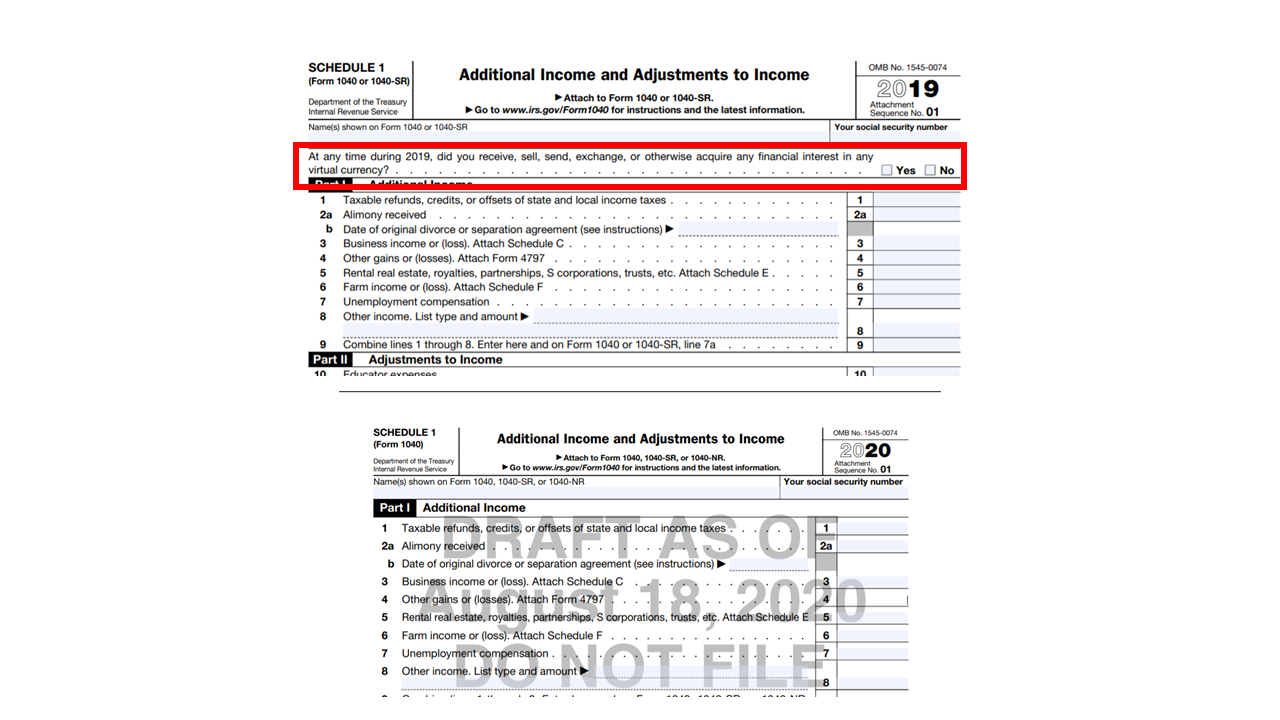

The IRS first introduced this question in the 2019 tax year on Schedule 1, but is now moving it to the front page of Form 1040.

Although the IRS has not yet publicly commented about this proposed change, this move shows IRS’s ongoing effort in getting more data on US virtual currency users. Currently, not every taxpayer has to file a Schedule 1 with their taxes. Schedule 1 is for taxpayers who have to report additional income (other than W-2 income) and make certain adjustments for that income. If you don't file a Schedule 1, you do not have to answer the virtual currency question. However, by adding the virtual currency question on page 1 of the tax return, everyone who files a personal tax return for the 2020 tax year will have to answer the question.

Time for a tweet storm. The IRS moved the crypto question to the front of 2020 draft form 1040. You might ask, so what's the big deal? I have seen this question in 2019 as well. Here is why it's a big deal.👇 pic.twitter.com/mQeaaf4i3G

— Shehan Chandrasekera, CPA 🧗♀️|🇱🇷|🇱🇰 (@TheCryptoCPA) August 21, 2020

If you’d like to get ahead of the curve on getting your cryptocurrency taxes done, CoinTracker can help. CoinTracker integrates with 300+ cryptocurrency exchanges and wallets as well as 3,000+ blockchains.

If you have any questions or comments about this change, please let us know on Twitter @CoinTracker.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.